分数维动态系统分析理论及其在中国证券市场中的应用

摘要本论文的研究工作得到国家自然科学基金项目(2004.1-2006.12编号70371070)“复杂系统结构演化边界带方法研究及其在金融系统管理中的应用”的支持。本文基于分形市场理论,以更好地研究具有分形结构的资本市场的行为和规律,提出分数维动态系统分析方法,并对沪深股市进行了实证研究。本文的主要研究工作如下:1.分析了有效市场理论的缺陷,对分形市场研究的发展、现状做了阐述,并对国内外资本市场的非线性研究进行了评述。2.综合考察了分数维系统的特性再结合复杂系统的共性,提出了分数维动态系统分析方法,分数维动态系统主要由三方面构成:一是系统的分数维性;二是维度的结构性;三是系统、边界和环境的动态...

相关推荐

-

XX中学英语学科质量提升计划书VIP免费

2025-01-09 8

2025-01-09 8 -

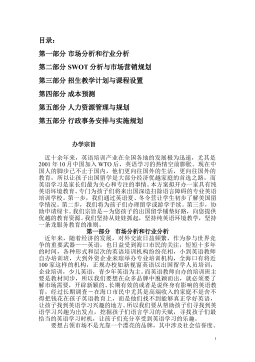

VIPKID-美国小学在家上-在线英语学习项目商业计划书VIP免费

2025-01-09 8

2025-01-09 8 -

English TV--英语学习智能视频平台创业商业计划书VIP免费

2025-01-09 11

2025-01-09 11 -

English TV,4--英语学习智能视频平台商业计划书VIP免费

2025-01-09 14

2025-01-09 14 -

260Educotton-让孩子快乐学习英语的平板电脑商业计划书VIP免费

2025-01-09 12

2025-01-09 12 -

XX英语学校创业策划书VIP免费

2025-01-09 11

2025-01-09 11 -

Ustudy-K12英语在线学习产品商业计划书VIP免费

2025-01-09 12

2025-01-09 12 -

Strawberry English School (SES)英语培训学校计划书VIP免费

2025-01-09 16

2025-01-09 16 -

《天中英语智能电子公司创业商业计划书》VIP免费

2025-01-09 13

2025-01-09 13 -

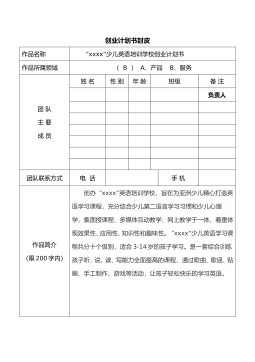

XXXX少儿英语培训学校创业计划书VIP免费

2025-01-09 21

2025-01-09 21

相关内容

-

XX英语学校创业策划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:WPS

价格:10 积分

-

Ustudy-K12英语在线学习产品商业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:PPTX

价格:10 积分

-

Strawberry English School (SES)英语培训学校计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

《天中英语智能电子公司创业商业计划书》

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

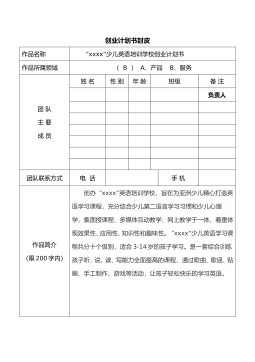

XXXX少儿英语培训学校创业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分