银行信贷对地域经济影响的研究—以山东省为例

VIP免费

摘 要

经济发展主要靠政策、科技和资金投入,资金的支持支撑着政策的实施和科

技的发展。金融体系的日益完善和金融市场的活跃对社会闲置资金向生产性投资

的转变起了重大作用,合理的市场机制能引导资金的流向,进而拉动经济发展,

所以金融业被称为现代经济中的核心。中国社会资金的配置主要还是通过银行信

贷来完成,银行信贷已成为了企业的主要融资渠道。因此,探讨银行信贷对地域

经济发展的影响,极具理论和现实意义。

银行贷款能直接解决企业融资难的问题,并通过对信贷结构进行调整,使地

区产业结构得到调整并且优化升级,从而带动地域经济的快速增长,推动银行业

今后的稳定发展。有关银行信贷与地域经济的关系,从地域经济的角度看,银行

信贷是地域经济发展的有利保障和助推器。银行通过加大对企业的信贷投放力度,

从而增加该地域的货币供给量;信贷结构调整后,地域产业结构也会同时得到调

整及优化升级,从而带动地域经济的快速增长。信贷不仅优化了资金的配置,也

提高了资金的使用效益。近年以来,山东省实体经济已得到强化,对资金的需求

能力大为增加,这也就要求以银行为代表的金融机构应加强信贷管理和服务,在

确保收益的情况下,降低制度门槛,提供资金支持从而进一步促进实体经济的发

展。

本文着眼于当前山东省的银行信贷与经济发展的现状,以 1978 年到 2012 年

的有关数据作为支撑,选取人均 GDP、银行贷款余额(LOAN)、信贷资金利用效

率(RGDPL)、全社会固定资产投资总额(FAI)等有关指标,建立实证模型,通

过数理分析研究信贷规模与经济增长之间的相关关系。并通过建立农业贷款和第

一产业产值、工业贷款和第二产业产值、商业贷款和第三产业产值三组序列的实

证模型来研究山东省信贷结构对产业结构的影响。最后得出在影响经济增长的相

关因素中,银行信贷对经济增长的贡献最大,银行信贷增长带动了经济增长,而

经济增长不一定促进银行信贷的增长;在信贷结构对产业结构的影响中,工业贷

款对第二产业产值的影响最大,商业贷款对第三产业的影响次之,并且该影响在

逐步扩大。最后根据山东省银行信贷与经济发展的现状和实证结果,分析出银行

信贷在经济发展中存在的问题并提出相应的政策建议,通过改善信贷市场中出现

的问题,从而使山东省经济能健康、平稳、持续、快速的发展。

关键词:银行信贷 地域经济 实证分析 信贷结构 产业结构

ABSTRACT

Economic development mainly rely on policy, technology and capital investment,

and capital investment supports the implementation of policy and the development of

science and technology. The increasing improvement of financial system and activity of

financial market play an important role on the transformation of the social idle capital to

productive investment. Reasonable market mechanism can guide the direction where

capital flows, and then pull the economic development, so the financial industry is

known as the core of modern economy. China's social capital allocation is mainly done

through bank credit, and bank credit has become the main financing channels of

enterprise. Therefore, discussion of the impact of bank credit on regional economic

development has theoretical and practical significance.

Bank loans directly solve the problems of the enterprise financing difficulties, and

through adjustment of the credit structure, regional industrial structure get optimization

and upgrading, therefore giving impetus to the rapid growth of regional economy and

promoting the steady development of banking industry in the future. As to the

relationship between bank credit and the regional economy, from the point of view of

the regional economy, bank credit is the guarantee as well as the booster of the

development of regional economy. Through strengthening of enterprise credit, banks

increase the money supply of the district; After adjustment of the credit structure,

regional industrial structure would also get optimization and upgrading, thereby leading

to the rapid growth of regional economy. Bank credit not only optimizes the allocation

of the funds, but also improve the benefit of the use of funds. In recent years, the real

economy of Shandong province has been strengthened, demand for money ability

increase greatly, which also requires more strengthen credit management and service of

financial institutions such as bank, Under the ensured yield, bank should lower the

difficulty of system to provide capital support to further promote the development of the

real economy.

This paper bases on the present situation of the current bank credit and economic

development in Shandong province, Data of GDP per capita, bank loan balances

(LOAN), the utilization efficiency of credit funds (RGDPL), the whole society total

fixed asset investment (FAI) and related indicators from 1978 to 2012 are used to

establish the empirical model to study the relationship between credit scale and

economic growth. To study the effects of the credit structure on the industrial structure

in Shandong province, three sequence empirical models are established, namely model

of agricultural loans and primary industry output value, industrial loans and the second

industry output value, and commercial loans and the tertiary industry output value. It is

concluded that bank credit is the key factor that influence the economic growth. Bank

credit growth can drive the economic growth, while economic growth does not

necessarily promote the growth of bank credit. On the impact of credit structure on the

of industrial structure, the influence of industrial loans to the second industry output

value is the largest, influence of business loans to the third industry comes the second,

but is gradually expanding. Finally according to the current situation of bank credit and

economic development in Shandong province and the empirical results, problems that

exist in the bank credit in the economic development are analyzed and corresponding

policy recommendations are put forward, Only by solving the problems appeared in the

credit markets, the economy in Shandong province can develop smoothly, continuously,

healthily and rapidly.

Key words: Bank Credit,Regional Economy,Empirical Analysis,

Credit Structure,Industrial Structure

目 录

中文摘要

ABSTRACT

第一章 绪 论 ...................................................... 1

1.1 研究背景及意义 ................................................. 1

1.2 文献综述 ....................................................... 2

1.2.1 国外研究综述 ............................................... 2

1.2.2 国内研究综述 ............................................... 4

1.2.3 文献综述的总结 ............................................. 7

1.3 研究内容和方法 ................................................. 7

1.3.1 研究内容 ................................................... 7

1.3.2 研究方法 ................................................... 9

1.4 论文主要的创新点与不足 ........................................ 10

第二章 银行信贷对地域经济增长作用的理论分析 ....................... 11

2.1 银行信贷理论 .................................................. 11

2.1.1 可借贷资金理论 ............................................ 11

2.1.2 信贷配给理论 .............................................. 11

2.2 区域经济发展理论 .............................................. 12

2.2.1 区域经济均衡发展理论 ...................................... 12

2.2.2 区域经济非均衡发展理论 .................................... 13

2.3 货币理论关于银行信贷与经济增长关系的分析 ...................... 15

2.3.1 古典经济学的货币中性论 .................................... 15

2.3.2 凯恩斯的货币非中性论 ...................................... 15

2.3.3 货币主义的货币中性与非中性观 .............................. 16

2.4 金融发展理论关于银行信贷与经济增长关系的分析 .................. 16

第三章 山东省银行信贷与经济发展现状分析 ........................... 18

3.1 山东省经济发展现状分析 ........................................ 18

3.1.1 山东省 GDP 增长现状 ........................................ 18

3.1.2 山东省第一、二、三产业产值增长现状 ........................ 19

3.2 山东省银行信贷增长现状分析 .................................... 22

3.2.1 银行信贷资金来源分析 ...................................... 22

3.2.2 银行信贷资金总量分析 ...................................... 23

3.2.3 银行信贷投放结构分析 ...................................... 24

3.3 山东省银行信贷与经济增长关系的初步估计 ........................ 26

3.3.1 信贷质量分析 .............................................. 26

3.3.2 山东省各市 GDP 总量与贷款余额的对比分析 .................... 27

3.3.3 经济增长与银行信贷增长的对比分析 .......................... 28

第四章 山东省银行信贷对经济发展的贡献研究 ......................... 30

4.1 实证方法的选择 ................................................ 30

4.1.1 单位根检验 ................................................ 30

4.1.2 协整检验 .................................................. 31

4.1.3 格兰杰因果关系检验 ........................................ 32

4.2 信贷规模与经济增长实证分析 .................................... 32

4.2.1 指标的选取和数据的处理 .................................... 32

4.2.2 ADF 单位根检验 ............................................ 34

4.2.3 Johansen 协整检验 ......................................... 35

4.2.4 Granger 因果检验 .......................................... 37

4.3 信贷结构与产业结构实证分析 .................................... 37

4.3.1 指标的选取和数据的处理 .................................... 37

4.3.2 ADF 单位根检验 ............................................ 39

4.3.3 Johansen 协整检验 ......................................... 39

4.3.4 Granger 因果检验 .......................................... 41

4.4 银行信贷与经济增长实证结果分析 ................................ 41

第五章 山东省银行信贷在经济增长中存在的问题及解决的对策 ........... 43

5.1 山东省银行信贷在经济增长中存在的问题 .......................... 43

5.1.1 信贷投向具有明显的行业集中性 .............................. 43

5.1.2 存贷期限错配风险加剧 ...................................... 44

5.1.3 中小企业融资难的问题仍未解决 .............................. 44

5.1.4 信贷资金投放区域不平衡 .................................... 45

5.1.5 商业贷款对第三产业的支持力度不够 .......................... 46

5.1.6 存贷比相对偏高,存款资源制约问题依然存在 .................. 47

5.2 优化银行信贷管理促进山东省经济增长的对策和建议 ................ 47

5.2.1 强化对银行信贷行业集中的监管 .............................. 47

5.2.2 拓宽融资渠道,调整信贷期限结构 ............................ 48

5.2.3 加大对中小企业的信贷支持 .................................. 49

5.2.4 制定区域差别化的信贷政策 .................................. 50

5.2.5 转变银行业观念,助力第三产业发展 .......................... 50

5.2.6 控制贷款规模,改善贷款质量 ................................ 51

结 论 .............................................................. 52

附 录 .............................................................. 53

参考文献 ........................................................... 62

在读期间公开发表的论文和承担科研项目及取得成果 ..................... 65

致 谢 .............................................................. 66

第一章 绪论

1

第一章 绪 论

1.1 研究背景及意义

中国改革开放以来,山东省的经济一直保持着持续、稳定、快速的发展,产

业结构逐渐走向合理化,经济效益在稳定的发展中不断得到提高,地区生产总值

每年平均的增长速度达到了 10%以上,继 2006 年全省生产总值突破 2万亿元后,

在2008 年又顺利突破了 3万亿元,国民经济的主要指标位于全国前列,已成为中

国的经济大省、强省。同时产业结构也得到了优化,第二、三产业迅速发展,所

占比重在持续上升。2000 年三产业之比为 15.2:50.0:34.8,到 2012 年已优化为

8.6:51.4:40.0。虽与国际惯例协调比例 1:4:5还有一定距离,但也已经有了翻

天覆地的变化。

山东省的经济之所以会有如此大的发展,与金融业的快速发展密不可分,特

别是银行信贷总量的大幅度增长为经济增长提供了重要的资金支持。山东省银行

信贷余额在 1957 年还仅仅只有 16.87 亿元,而到 2012 年,已达到了 40021.49 亿

元。信贷的迅猛发展,不仅仅表现在信贷总量的快速增长,信贷结构也已不断得

到优化。并且山东省仍处于经济逐步向现代化进程迈进的初步阶段,投资的快速

增长和人力的大量投入推动着经济的加速增长,而投资的快速增长是以信贷的扩

张作为支撑的。但由于资源利用效率较低以及技术水平不高等原因,导致经济增

长表现出粗放型的经济特征。信贷的快速增长成为这一时期经济发展的重要推动

力,并且随着改革的不断深入,这一趋势将表现得更加明显。

对于银行信贷与地域经济增长之间的关系,从地域经济增长的角度来看,随

着金融在国民经济中的作用日益增强,银行信贷已成为筹集和分配经济建设资金

的一条重要渠道,是国家经济发展战略的要求。通过调整信贷结构可以合理的促

进产业结构的调整和优化升级,而调整产业结构、发展基础产业、合理和优化产

业结构已是经济协调稳定持续发展、社会资源有效配置和高效利用的基本条件,

是经济现代化的重要标志。从银行的角度来看,商业银行可通过信用创造功能使

货币在流通过程中产生数倍扩张的效应,整个银行体系可以形成数倍于原始存款

的派生存款,使得储蓄以更高效率的方式转变为投资,从而提高银行信贷资金的

配制效率和使用效率。

由此可见,在未来的经济发展过程中,为使山东省的经济保持持续快速的增

长,其主导力量仍可能是银行信贷的贡献度。从而可得出,银行信贷对山东省地

域经济增长存在明显的正相关作用。他们两者都实现了快速增长,且变化趋势基

摘要:

展开>>

收起<<

摘要经济发展主要靠政策、科技和资金投入,资金的支持支撑着政策的实施和科技的发展。金融体系的日益完善和金融市场的活跃对社会闲置资金向生产性投资的转变起了重大作用,合理的市场机制能引导资金的流向,进而拉动经济发展,所以金融业被称为现代经济中的核心。中国社会资金的配置主要还是通过银行信贷来完成,银行信贷已成为了企业的主要融资渠道。因此,探讨银行信贷对地域经济发展的影响,极具理论和现实意义。银行贷款能直接解决企业融资难的问题,并通过对信贷结构进行调整,使地区产业结构得到调整并且优化升级,从而带动地域经济的快速增长,推动银行业今后的稳定发展。有关银行信贷与地域经济的关系,从地域经济的角度看,银行信贷是地...

相关推荐

-

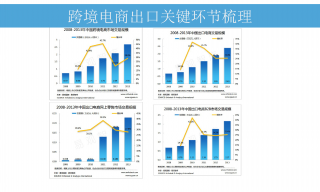

跨境电商商业计划书模版VIP免费

2025-01-09 27

2025-01-09 27 -

跨境电商方案范文VIP免费

2025-01-09 14

2025-01-09 14 -

创业计划书VIP免费

2025-01-09 18

2025-01-09 18 -

xx生鲜APP计划书VIP免费

2025-01-09 12

2025-01-09 12 -

跨境电商创业园商业计划书(盈利模式)VIP免费

2025-01-09 8

2025-01-09 8 -

跨境电商计划书VIP免费

2025-01-09 13

2025-01-09 13 -

绿色食品电商平台项目计划书VIP免费

2025-01-09 22

2025-01-09 22 -

农产品电子商务商业计划书VIP免费

2025-01-09 8

2025-01-09 8 -

农村电商平台商业计划书VIP免费

2025-01-09 13

2025-01-09 13 -

生鲜商城平台商业计划书VIP免费

2025-01-09 21

2025-01-09 21

作者:赵德峰

分类:高等教育资料

价格:15积分

属性:70 页

大小:1MB

格式:PDF

时间:2024-11-19