我国分级基金折溢价率影响因素的实证研究

摘要我国的基金市场一直缺乏杠杆型的投资产品,而分级基金的诞生恰好填补了这一空白,作为基金市场非常重要的一个创新,它不仅满足了投资者更为细致的风险和收益需求,还对促进资产的优化配置和提高基金行业的整体发行规模均有积极作用。分级基金的魅力不仅在于通过杠杆放大收益,还可以利用折溢价率进行套利。但是分级基金是一把双刃剑,因为其交易价格的波动十分活泼,常常在一个星期之内就突发性上涨,也可能没有预兆的忽然下跌。尤其对于那些“买涨不买跌”的投资者来说可能会造成巨大的损失。所以,只有在深入了解分级基金特性的前提下,进一步掌握分级基金折溢价变动的影响因素,才能够避免盲目跟风,做到理性投资。在此背景下,探讨影响我...

相关推荐

-

XX中学英语学科质量提升计划书VIP免费

2025-01-09 8

2025-01-09 8 -

VIPKID-美国小学在家上-在线英语学习项目商业计划书VIP免费

2025-01-09 8

2025-01-09 8 -

English TV--英语学习智能视频平台创业商业计划书VIP免费

2025-01-09 9

2025-01-09 9 -

English TV,4--英语学习智能视频平台商业计划书VIP免费

2025-01-09 10

2025-01-09 10 -

260Educotton-让孩子快乐学习英语的平板电脑商业计划书VIP免费

2025-01-09 10

2025-01-09 10 -

XX英语学校创业策划书VIP免费

2025-01-09 10

2025-01-09 10 -

Ustudy-K12英语在线学习产品商业计划书VIP免费

2025-01-09 11

2025-01-09 11 -

Strawberry English School (SES)英语培训学校计划书VIP免费

2025-01-09 12

2025-01-09 12 -

《天中英语智能电子公司创业商业计划书》VIP免费

2025-01-09 12

2025-01-09 12 -

XXXX少儿英语培训学校创业计划书VIP免费

2025-01-09 12

2025-01-09 12

作者详情

相关内容

-

XX英语学校创业策划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:WPS

价格:10 积分

-

Ustudy-K12英语在线学习产品商业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:PPTX

价格:10 积分

-

Strawberry English School (SES)英语培训学校计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

《天中英语智能电子公司创业商业计划书》

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

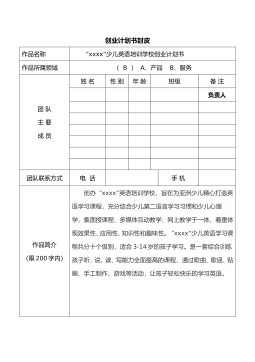

XXXX少儿英语培训学校创业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分