基于VaR模型的银行同业拆借利率风险度量研究

浙江财经学院硕士学位论文摘要商业银行利率风险是指利率风险资产因利率波动导致其价值向不利方向运动的不确定性,随着我国利率市场化的推进,尤其是2008年金融危机爆发以来,受国际经济形势和国内经济形势的影响,利率波动日益频繁和剧烈,特别是同业拆借利率,作为我国市场化程度最高的利率之一,其敏感性日益加强。如何提高同业拆借利率风险度量准确性越来越受到我国商业银行的重视,而准确度量利率风险关键是选择什么样的度量方法,当前国际上运用最广泛的利率风险度量模型VaR模型法,利率风险度量VaR模型能否准确预测利率风险对商业银行来说非常重要。本文在国内外学者研究的基础上,将ARMA-GARCH族模型引入到VaR模型...

相关推荐

-

人教PEP英语-((开学摸底测试 综合提升卷)2023-2024学年五年级英语上册开学摸底考试卷(一)(人教PEP版)VIP免费

2024-09-30 10

2024-09-30 10 -

人教PEP英语-((开学摸底测试 重难点必刷卷)2023-2024学年四年级英语上册开学摸底考试卷(二)(人教PEP版)VIP免费

2024-09-30 11

2024-09-30 11 -

人教PEP英语-((开学摸底测试 重难点必刷卷)2023-2024学年五年级英语上册开学摸底考试卷(二)(人教PEP版)VIP免费

2024-09-30 10

2024-09-30 10 -

人教PEP英语-((开学摸底测试 综合提升卷)2023-2024学年四年级英语上册开学摸底考试卷(一)(人教PEP版)VIP免费

2024-09-30 10

2024-09-30 10 -

人教PEP英语-(2023-2024学年六年级英语上册开学摸底考试卷A卷(人教PEP版)VIP免费

2024-09-30 8

2024-09-30 8 -

人教PEP英语-(2023-2024学年六年级英语上册开学摸底考试卷B卷(人教PEP版)VIP免费

2024-09-30 8

2024-09-30 8 -

人教PEP英语-(开学摸底测试 易错题精选卷)2023-2024学年五年级英语上册开学摸底考试卷(三)(人教PEP版)VIP免费

2024-09-30 8

2024-09-30 8 -

外研版英语-(开学摸底测试 易错题精选卷)2023-2024学年六年级英语上册开学摸底考试卷(三)(外研版三起)VIP免费

2024-09-30 8

2024-09-30 8 -

外研版英语-(开学摸底测试 易错题精选卷)2023-2024学年五年级英语上册开学摸底考试卷(三)(外研版三起)VIP免费

2024-09-30 8

2024-09-30 8 -

外研版英语-(开学摸底测试 重难点必刷卷)2023-2024学年六年级英语上册开学摸底考试卷(二)(外研版三起)VIP免费

2024-09-30 8

2024-09-30 8

作者详情

相关内容

-

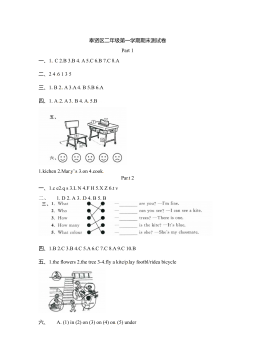

2019-2020学年2年级松江区英语上期末试卷答案

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

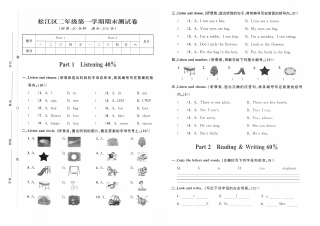

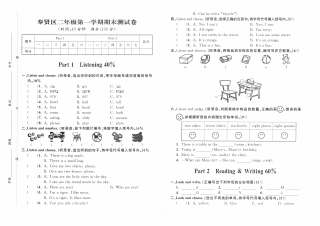

2019-2020学年2年级松江区英语上期末试卷

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:PDF

价格:5 积分

-

2019-2020学年2年级奉贤区英语上期末试卷答案

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

2019-2020学年2年级奉贤区英语上期末试卷

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:PDF

价格:5 积分

-

2021-2022学年牛津上海版(试用本)二年级上册期中模拟测试英语试卷(原卷版)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分