代际交叠结构框架下的人力资本内生经济增长模型研究

VIP免费

摘 要

2008 年金融危机爆发以来,世界经济开始进入下行通道并持续至今。如何提

振经济,保证经济增长,成为经济学界讨论的热点议题。经济增长问题一直以来

是宏观经济学研究的一个重要部分,从古典经济增长理论到新古典增长理论再到

新增长理论,经济增长理论历经了一个从宏观驱动因素研究到对宏观增长的微观

基础的构建再到关键要素内生的过程。其中最具应用价值和研究意义的当属以代

际交叠模型为代表的新古典增长框架和以罗默、卢卡斯等人的研究为代表的人力

资本内生经济增长框架。两种框架各具特色、各有长短,新古典模型完美地描述

了经济增长的稳态均衡及实现均衡的各因素的动态路径,但是无法解释经济长期

增长的动因和模式;内生经济增长理论成功的解释了技术进步的来源和驱动机制,

却难以进行实证分析检验。可以看出,两种理论框架之间存在明显的互补性,然

而迄今为止,还鲜有研究能通过某种渠道将两框架进行相互融合,两种理论之间

仿佛存在着一条难以逾越的鸿沟。

基于此,本文将以人力资本理论为视角,对代际交叠模型进行较大程度的修

正,建立以人力资本投资变量为基础的三期代际交叠的约束结构,并在该结构下,

构建物质资本生产人力资本的内生经济增长模型框架,在该模型框架下分析经济

个体(或家庭)的最优消费行为、厂商利润最大化决策以及经济整体的稳态均衡

的实现,并讨论稳态条件下的物质资本、人力资本的积累规律以及两种资本比率

的均衡值、消费和投资的社会福利最大化和本模型下的动态无效率及其调节等问

题。模型以经济个体消费决策内生的人力资本投资变量为纽带,实现代际交叠的

思想与内生增长理论的对接,力求填补新古典增长框架与内生经济增长框架之间

的“鸿沟”。

本文研究的代际交叠内生增长模型是以微观分析为基础的动态模型。模型开

始于对消费函数的构建,强调代际结构,认为不同代际的个体有不同的消费倾向

和财富水平,理性的个体在每个时期的经济决策都要对整个有限期界的生命周期

内的预期和续存做出考虑,其中人力资本投资和保障性储蓄是最基本和必须的经

济行为。作为纽带,人力资本要素也将宏观和微观联系起来,该要素通过个体的

收入分配决策实现以物质资本为基础的微观内生,并以代际结构的供给模式内化

到经济增长理论研究,达到微观和宏观的较完整结合。

通过模型分析,可以得到本研究框架下的经济实现稳态的基本条件,进而得

到稳态均衡中的人力资本与物质资本相互作用下的各自运动路径和各变量的均衡

增长率及其相互关系,以及常规情况下经济稳态水平脱离福利最大化的“黄金律”

水平的动态无效率产生原因的解释。在此基础上,引入政府政策的调节作用,将

政府行为内生化。基本经济要素宏观研究的微观内生可以使本研究模型十分方便

进行经验检验和实证研究。本文在后面以与本研究模型密切相关的财政人力资本

投入问题和养老保障机制问题为具体实例,利用我国的实际数据对两个问题现状

对我国经济的影响情况做了实证分析。最后,根据理论研究和实证分析得出的结

论,对我国经济增长的促进政策提出了一些建议,以期为我国经济更好更快发展

提供理论和政策借鉴。

关键字:代际交叠、人力资本、内生经济增长、运动路径、“黄金律”

水平

ABSTRACT

Since the financial crises occurred in 2008, economy of the world began to enter

the downstream channel and persisted to now. How to boost the economy and ensure

economic growth is the hot topic among economists. The issue of economic growth is a

important part of macroeconomics. From classical economic growth theory to the

neo-classical growth theory and then to the new growth theory, economic growth theory

has experienced a process of going from macro drivers research to the construction of

micro-based for macro growth and to the endogeny of key factors. Among that, the

neo-classical growth framework represented by the overlapping generation model and

human capital endogenous growth framework represented by the studies of Romer,

Lucas, etc., are the the theories with the most application value and significance. These

two frameworks have different features and advantages. The neo-classical model

perfectly descript the balanced steady-state equilibrium of economic growth and its

dynamic path of the various factors, but can’t explain the motives and modes of

long-term economic growth; endogenous growth theory successfully explained the

origin of technological progress and drive mechanism, while have difficulty on the

empirical analysis. We can see that there are obvious complementarities between them.

However, few studies can mutually integrate the two frameworks with a special channel

up to now. There seems to be an insurmountable gap between the two theories.

Based on the above, this paper will take the human capital theory as reseaching

perspective to modify the overlapping generation model in a widely range and establish

consumption restriction structure of three overlapping generations based on variable of

human capital investment. Then, build a analysis frame of endogenous growth model

with material capital product human capital. Under this frame, the paper discusses some

problems as below: the optimal consumption behavior of the economic individual (or

family), profit-maximizing behavior of firms as well as the steady-state equilibrium of

the whole economy. With the steady-state conditions, analyzes the accumulation pattern

of physical capital and human capital, and equilibrium value of the two capital

investment ratio, the social welfare maximization of consumption and investment as

well as the Dynamic Inefficient in the economics. The research model take the human

capital variable which is endogenous by individual consumption decisions as a link,

achieve a successful docking between the ideas of intergenerational overlap with

endogenous growth theory, which is seeking to fill the “gap” between neoclassical

growth framework and endogenous growth framework.

The endogenous growth model under overlapping generation frame, which is

studied in this paper, is a dynamic model based on microscopic analysis. The model

research begins with the construction of the consumption function, emphasizing the

inter-generational structure. It points that individuals of different generations have

different propensity to consume and wealth levels, rational individual will concern the

expectation and continue exsit of limited duration for the entire life when he/she does

economic decision-making in every period. Among that the human capital investment

and savings for protection is the most basic and necessary economic behavior. As a link,

human capital factor connects macro and micro, and realize the micro-endogenous in

the foundation of physical capital through the allocation decisions of the individual's

income, then achieve a perfect combination of micro and macro by the research of

economic growth theory with the intergenerational supply structure model.

In the research, we can get the fundamental conditions of reaching the economic

steady-state, and then obtain the moving paths of human capital and material capital

under the interaction of each other, as well as the growth rates and relationship of

variables in the model under steady-state equilibrium situation, and the explanation of

dynamic inefficiency which means the general economic situation in steady-state

deviate from the welfare-maximizing level of “golden rule” horizontal. After that, we

bring in the role of government policy, and endogen the behaviors of government. The

studies are very convenient for empirical testing and research because of the micro

endogenous of the macro-economic fundamental factors. The next, for a specific

examples, we choose two problems of financial human capital investment and pension

protection mechanism—which is closely related to the studies in this paper—to extend

the research results, and do an empirical analyses with the actual data of our country

about the impact on China's economy of the two problems’ present situation. Finally,

according to the theory research and empirical conclusion, we put forward

recommendations for policies of China's economic growth promotion, with a view to

develop China's economic better and faster.

Key Word: Overlapping Generation; Human Capital; Endogenous

Growth; Movement Path; "Golden Rule" Level

目 录

摘 要

ABSTRACT

第一章 绪 论 .................................................................................................................. 1

1.1 研究背景及问题提出 ........................................................................................ 1

1.2 论文研究的理论和现实意义 ............................................................................ 2

1.2.1 理论意义 .................................................................................................. 2

1.2.2 现实意义 .................................................................................................. 3

1.3 思路框架、主要内容与研究方法 .................................................................... 4

1.3.1 思路框架 .................................................................................................. 4

1.3.2 主要内容和行文框架 .............................................................................. 5

1.3.3 研究方法 .................................................................................................. 5

1.4 主要可能创新点 ................................................................................................ 6

第二章 研究的理论基础和相关文献综述 .................................................................... 8

2.1 论文研究的理论基础 ........................................................................................ 8

2.1.1 Solow-Swan 经济增长模型 ...................................................................... 8

2.1.2 Ramsey-Case-Koopmans 模型.................................................................. 9

2.1.3 内生增长理论 .......................................................................................... 9

2.1.4 现代人力资本理论 ................................................................................ 10

2.2 国内外相关文献综述 ....................................................................................... 11

2.2.1 宏观经济中的消费函数设计问题的研究评述 ..................................... 11

2.2.2 人力资本与经济增长的相关研究综述 ................................................ 12

2.2.2.1 人力资本与经济增长的相互关系研究 ...................................... 13

2.2.2.2 人力资本投资对经济增长的作用及其度量的研究 ................... 13

2.2.3 养老保险对经济增长影响的研究综述 ................................................ 14

第三章 代际交叠模型及其人力资本修正的三个代际结构的划分 .......................... 16

3.1 代际交叠模型的提出和发展 .......................................................................... 16

3.2 代际交叠模型的研究和应用 .......................................................................... 16

3.3 代际交叠模型的缺陷分析和修正思路 .......................................................... 17

3.4 OLG 模型的代际修正:三个代际的划分 ...................................................... 18

第四章 代际交叠结构下的人力资本内生增长模型分析 .......................................... 21

4.1 研究准备——两种资本的单部门内生增长模型 .......................................... 21

4.2 模型基本假设 .................................................................................................. 22

4.3 代际交叠结构下的内生增长模型分析的基本架构 ....................................... 22

4.3.1 决策环境:偏好、技术、人口、禀赋、资源约束 ............................ 22

4.3.2 个体消费者生命周期内效用最大化行为 ............................................ 25

4.3.2.1 消费约束函数的构建 .................................................................. 25

4.3.2.2 效用函数的构建 .......................................................................... 25

4.3.2.3 最大化均衡分析 .......................................................................... 26

4.3.2.4 最优平均消费倾向和均衡储蓄率 .............................................. 27

4.3.2.5 求解最优消费增长率 .................................................................. 28

4.3.2.6 个体最优人力资本投资决策的求证 .......................................... 28

4.3.3 厂商利润最大化行为 ............................................................................ 29

4.3.4 模型的竞争均衡 .................................................................................... 29

4.4 最优经济方法求解模型的均衡资本路径、“黄金律”水平及对动态无效率解

释 ............................................................................................................................. 32

4.4.1 最优经济方法对模型求解 .................................................................... 32

4.4.2 两种资本相互作用下的运动路径和整体经济的运行分析 ................ 36

4.4.2.1 人力资本既定情况下的物质资本的运动 .................................. 36

4.4.2.2 物质资本既定情况下人力资本运动 .......................................... 37

4.4.2.3 整体经济的运行 .......................................................................... 38

4.4.3 最优物质资本-人力资本比与稳态中经济及其各要素的增长率 ....... 38

4.4.4 储蓄率的变动效应与“黄金律”水平经济增长 ..................................... 41

4.4.4.1 储蓄率变动的资本效应 ............................................................... 41

4.4.4.2 储蓄率变动的消费效应和“黄金率”水平 .................................... 41

4.4.5 经济动态无效率原因与政府行为的引入 ............................................ 44

第五章 模型验证——基于我国教育和养老保障数据的实证分析 .......................... 46

5.1 我国的人力资本财政教育投资对经济发展影响的实证分析 ...................... 46

5.1.1 政府政策介入人力资本投资的原因与效应分析 ................................. 46

5.1.1.1 人力资本投资的正外部性导致市场供给不足 .......................... 46

5.1.1.2 人力资本投资风险的不确定性产生“溢价”的要求 ................... 47

5.1.1.3 市场调节造成人力资本投资的不对称信息无效率和结构失调

................................................................................................................... 47

5.1.2 我国财政教育投资的现状 ..................................................................... 48

5.1.3 现行的财政教育投资政策对经济增长影响的实证分析 .................... 49

5.1.3.1 实证模型构建 .............................................................................. 49

5.1.3.2 数据收集和整理 .......................................................................... 50

5.1.3.3 实证分析结果 .............................................................................. 51

5.2 我国的养老保障制度及其对经济发展的实证分析 ...................................... 52

5.2.1 养老保障制度的经济增长作用机理分析 ............................................ 52

5.2.1.1 完全基金制 .................................................................................. 52

5.2.1.2 现收现付制 .................................................................................. 53

5.2.2 我国养老保障制度现状 ........................................................................ 54

5.2.3 现行的养老保险政策对经济增长的影响的实证分析 ........................ 55

5.2.3.1 养老保障投入对社会投资的影响的实证分析 .......................... 55

5.2.3.2 养老保障投入对居民消费影响的实证分析 .............................. 57

第六章 基于模型分析对我国经济增长促进政策的建议 .......................................... 61

6.1 出台积极措施保证人力资本投资的最优规模和结构 .................................. 61

6.2 扩大内需,保障消费者福利稳步提升 ........................................................... 63

6.3 合理固定资产投资结构,提高物质资本使用效率 ...................................... 64

6.4 改革现行养老保障体制,强化经济发展后盾 .............................................. 65

6.5 优化人口政策,稳定劳动力供给结构 .......................................................... 66

结 语 .............................................................................................................................. 68

参考文献 ........................................................................................................................ 69

在读期间公开发表的论文和承担科研项目及取得成果 ............................................ 74

致 谢 .............................................................................................................................. 76

第一章 绪 论

1

第一章 绪 论

1.1 研究背景及问题提出

经济增长理论经过近百年来的发展,业已取得了长足的进步。尤其是近五、

六十年以来,从古典经济增长理论到新古典增长理论再到新增长理论,学者们试

图通过建立各种模型,探索经济增长的动力和源泉,阐述经济增长的内在规律,

解释国家和地区间的经济发展水平的差异,迄今为止,已经形成一个庞大的理论

体系。然而,前期的理论研究集中于对系统唯一均衡点即经济中稳态的经济增长

路线的分析(Barro & Sala-i-Matin,1999)。显然,这不能有效解释现实社会中复

杂多变的经济现象。同时这些理论多关注外生经济因素的变动对经济增长产生的

影响(曹栋,2010),但是我们可能更关心如何实现关键变量的经济系统内生并寻

找其对经济增长影响的机制。基于此,本文站在人力资本理论视角,通过对经典

的世代交叠模型(P. A. diamond,1965)的代际结构修正,建立代际交叠的框架下

的内生经济增长模型,以解决经济增长过程中的关键变量如储蓄率、人力资本投

资、政府决策等的系统内生问题。

前人研究已证明,消费、投资和国际贸易等因素的变动对于经济增长和经济

波动起着决定作用。在一个 Robinson 经济中,投资的高低取决于社会储蓄率水平,

而储蓄率水平取决于个人(或家庭)的消费决策。微观主体对消费和储蓄的选择,

是宏观消费和资本积累的基础,任何影响到消费决策的因素和政策都会影响到总

体的经济增长和经济波动。这就为我们的研究提供了一个可靠的切入点:应该在

一个合理的经济增长分析框架下,通过分析微观经济变量(例如教育、养老、消

费选择等)的相互作用,来研究宏观经济问题(比如消费、投资、技术进步、经

济增长乃至失业、通货膨胀、经济周期)。因此,决定个体(或家庭)的消费行为

的消费函数微观设计,应该成为宏观经济增长研究的基石。

从J. M. Keynes 的绝对收入理论到 J. S. Duesenberry 的相对收入理论,再到 F.

Modigliani 的生命周期理论和 M. Friedman 持久收入理论,消费理论进过一系列的

的变迁:消费者决策面临的约束由简单的预算约束过渡到资本市场弱势有效条件

下的流动性约束,消费者行为也由完全理性合理化为理性预期,并据其在不确定

性条件下进行决策(朱信凯、骆晨,2011)。理性预期的盛行使 Samuelson(1956)

和Diamond(1965)等人的代际消费函数的意义凸显出来,代际消费函数呈分段

式,把人的有限生命周期内不同阶段的消费状况区分开来,这样自然地引入了不

同代际和代际间的消费规划问题,如养老金问题等。但是,在该消费理论下,还

有一个问题应该被讨论,虽然在 Diamond 等人的理论中并未提及。那就是:个体

相关推荐

-

【拔高测试】沪教版数学五年级下册期末总复习(含答案)VIP免费

2024-11-19 19

2024-11-19 19 -

【基础卷】小学数学五年级下册期末小升初试卷四(沪教版,含答案)VIP免费

2024-11-19 9

2024-11-19 9 -

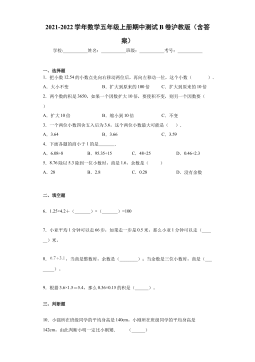

期中测试B卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 11

2024-11-19 11 -

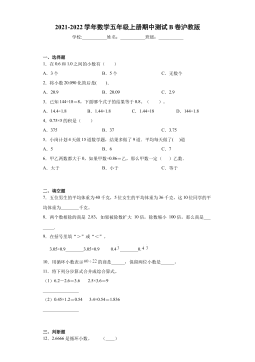

期中测试B卷(试题)- 2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 16

2024-11-19 16 -

期中测试A卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 18

2024-11-19 18 -

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 25

2024-11-19 25 -

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 23

2024-11-19 23 -

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 31

2024-11-19 31 -

【七大类型简便计算狂刷题】四下数学+答案

2025-03-18 16

2025-03-18 16 -

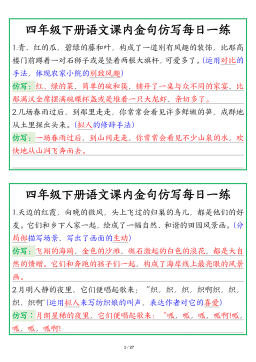

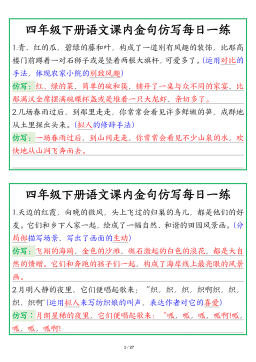

【课内金句仿写每日一练】四下语文

2025-03-18 39

2025-03-18 39

作者:侯斌

分类:高等教育资料

价格:15积分

属性:80 页

大小:3.94MB

格式:PDF

时间:2025-01-09

相关内容

-

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【七大类型简便计算狂刷题】四下数学+答案

分类:中小学教育资料

时间:2025-03-18

标签:数学计算;校内数学

格式:PDF

价格:1 积分

-

【课内金句仿写每日一练】四下语文

分类:中小学教育资料

时间:2025-03-18

标签:无

格式:PDF

价格:1 积分