大数据视角下农业供应链金融研究

VIP免费

摘 要

近年来,我国经济增速不断减慢,发展模式正由“粗放型”向“集约型”转

化,经济呈现新常态,产业结构处在不断优化中。作为国民经济的重要组成部分,

电子商务在其中发挥了很大影响。目前,中国电子商务发展迅速,业务模式不断

扩展,在传统的 B2B、B2C 和C2C 交易量屡创新高的情况下,互联网金融又异军

突起。作为电子商务行业领头羊的阿里巴巴,在互联网金融领域率先发力,不仅

创立了第三方支付平台—支付宝,还推出了阿里小贷等产品。之后,互联网金融

产品如雨后春笋,不断涌现,互联网金融正对人们生活产生深远影响。

作为互联网金融的一种业务模式,供应链金融凭借其对行业上下游资源的整

合能力,在各个领域都有广阔的发展前景,尤其对人类赖以生存的农业生产。然

而,农业供应链金融近年来刚刚提出,人们对它的运行规律、运作机理和运行方

式等还不太熟悉,对不同主导类型的农业供应链金融优劣势缺乏足够认识,对合

适的区域发展模式缺乏实践探索;此外,在农业供应链金融中,核心企业评估指

标体系的确立、核心企业的选择与评价等,缺少行之有效的方法;融资过程的风

险管控和收益分配也缺乏合理的机制。有鉴于此,本文对此问题进行了研究。在

综合分析农业供应链金融业务模式、运作机制的基础上,以上海农业,尤其是上

海生猪产业发展为例,进行分析,并得出结论。

首先,分析了国内外供应链金融现状,基于农业生产流程将农业供应链融资

的业务模式分为预付款融资、存货融资和应收账款融资。在对现状分析的基础上,

提出了农业供应链金融存在的问题,包括大数据经营问题、主导模式选择、核心

企业评估问题、风险管控和收益分配等问题。

在农业大数据经营问题中,分析了大数据在农业场景中的应用及其优势,对

大数据平台搭建过程的难点进行逐一分析。基于对流程的了解,构思出“上海市

农业供应链金融大数据信息平台”,平台分为四部分,依次是数据平台、资讯平台、

融资平台和互动平台。

关于主导模式的选择和核心企业评估的问题,本文以上海农业供应链发展为

例。首先分析了上海市现有的五种主导型农业供应链,总结其优劣势,得出核心

企业主导型的农业供应链金融最适合当前上海农业发展的需求。随后,针对上海

生猪产业进行具体分析。在生猪市场和企业指标体系建立的过程中,利用大数据

系统 Hadoop 平台中的 MapReduce 框架,运用 K-means 聚类算法,得出指标体系。

随后,运用典型相关分析,提取综合变量,以反映两组指标的整体相关程度。文

章在对比了上海梅林和新五丰两家企业与上海市生猪产业链之间的相关性后,得

出上海梅林更适合作为上海市生猪产业链中的主导企业。

作为合作博弈值的分配方法之一,Shapley 值法满足可行性、帕累托最优和各

节点企业都是理性的三个条件。运用它对供应链上的每个节点进行成本分配,每

个节点承担的成本总和恰为整个供应链的成本,且每个节点承担的成本小于等于

其单独生产时的成本。最后,基于大数据视角,从风险评估、风险度量和风险控

制三个方面出发,提出了大数据技术在农业供应链金融风险管控的模型。通过观

察最终收益,得到整合的农业供应链金融不仅能提高各参与方的收益,也使农业

供应链金融的整体收益有所提升。

本文拓展了大数据分布处理技术和数据挖掘技术的研究范围,探索了其在农

业领域中的具体应用模式,为现代农业和国际商务的发展提供了新的视角。这对

加快现代农业发展,提高农业经济效率,推动农业供应链金融发展具有重要意义。

本文的创新体现在四个方面。一是对农业大数据经营问题进行分析,提出构

建上海农业大数据信息平台的具体思路;二是运用大数据 Hadoop 平台中的 Map

Reduce 框架,结合 K-means 聚类算法,得出上海市生猪产业和供应链中核心企业

评估的指标;三是运用数据挖掘方法—典型相关分析,得出供应链中核心企业选

择的方法;四是基于大数据视角,从风险评估、风险度量和风险控制三个方面出

发,提出农业供应链金融风险管控的方法。

关键词:农业 供应链金融 大数据

Abstract

In recent years, Chinese economy grows more slowly than before. Its developing

model changes from loosen to intensive. The economy presents “The New Norm”. The

industrial structure is also under sustainable changes. To be an essential part of domestic

economy, e-commerce has great impact on it. At this moment, its model broadens the

wide. Traditional models like B2B, B2C and C2C are with good performance. Internet

Finance turns out. For example, Alibaba creates third-party payment platform and Ali

small loan. The other two giants of BAT, Tencent and Baidu also launch their internet

financing products. It can be seen that Internet Finance would have profound impact on

human life.

To be a model of Internet Finance, Supply chain finance has broad prospect. It’s

famous for the integration ability in the streamline, especially for human lying

industry-agriculture. Agricultural supply chain finance appeared not long ago, so people

are not familiar with its operating rules, operational mechanism even operating method.

Also do not have sufficient knowledge and experiences in core business-oriented,

third-party logistics oriented, farmer-led cooperative organizations oriented and

supermarket-oriented. In addition, it lacks effective method to evaluate and assess.

There’s also no fair and reasonable income distribution mechanism. For this purpose,

this paper takes Shanghai agriculture, especially pork industry as an example to analyze

all these problems.

Firstly, this paper assesses the condition of supply chain fiancé both abroad and

domestic, summarizes three business models, such as advanced payment finance,

inventory finance and accounts receivable finance. Based on above analysis, this paper

puts out problems in agricultural supply chain finance such as big data operating, core

enterprise issue, risk control and income distribution issues.

As to the big data management in agriculture, the whole process can be divided

into five parts, data collection, data storage, data analysis, data mining, and data

explanation. Then I propose the idea to build Shanghai agricultural big data platform

and how to build.

With regard to the core business assessing and selection, the first thing is to

analyze five existing models and to summarize their vantages and disadvantages thus

can reach the most suitable model. Then I used MapReduce framework in Hadoop

Platform with K-means clustering algorithm and combining economic knowledge to

establish index system. Subsequently, using data mining methods - canonical correlation

analysis extracts representative composite variables to reflect overall correlation. By

contrasting the relevance between two companies, I draw out Shanghai Meilin is

suitable.

Finally, based on the idea of agricultural information platform, I start from three

aspects- risk assessment, risk measurement and risk control, proposed agricultural

supply chain financial risk management and control methods. As to benefit analysis of

each node in the agricultural supply chain, I use cooperative game Shapley value that

satisfies the feasibility of Pareto optimality and each node is rational. It can be seen

Shapley value method can ensure fair and equitable distribution of interests of all parties

in the supply chain. Furthermore, by observing the final income, get integrated

agricultural supply chain finance not only increases the income of the parties involved,

but also improved the financial benefits of the entire agricultural supply chain.

In summary, big data can do a lot in agricultural sector. This paper is just tip of the

iceberg, only provides new perspective to agricultural development. What’s more, we

can see that canonical correlation analysis is feasible, which is helpful to promote

agricultural modernization.

Innovation of this paper is reflected in five aspects. First, analyzed big data

managing problem and put out the idea to build Shanghai agricultural big data platform;

Secondly, using MapReduce framework in distributed systems platform Hadoop with

arithmetic average clustering to derive the index system of Shanghai hog industry and

core enterprise assessment in supply chain. Thirdly, this paper combines data mining

methods - canonical correlation analysis to select core enterprise in supply chain.

Subsequently, using the thinking of big data, I propose agricultural supply chain

financial risk management approach from the three aspects, risk assessment, risk

measurement and risk control. Finally, used cooperative game Shapley value to analyze

benefit distribution in agricultural supply chain finance, the results confirmed the

Shapley value can guarantee equitable income distribution of each node in supply chain.

Key Words: Agriculture, Supply Chain Finance, Big Data

目录

中文摘要

Abstract

第一章 绪论 .................................................................................................................... 1

1.1 研究背景 ................................................................................................................ 1

1.2 研究目的和意义 .................................................................................................... 1

1.3 研究思路及研究方法 ............................................................................................ 2

1.4 创新点 .................................................................................................................... 4

1.5 国内外文献综述 .................................................................................................... 4

1.5.1 农业供应链金融研究现状 ............................................................................. 4

1.5.2 大数据研究现状 ............................................................................................. 6

1.6 本章小结 ................................................................................................................. 6

第二章 相关概念与理论 ................................................................................................ 8

2.1 相关概念 ................................................................................................................ 8

2.1.1 大数据概述 ..................................................................................................... 8

2.1.2 大数据金融 ..................................................................................................... 8

2.1.3 农业供应链金融 ............................................................................................. 9

2.2 相关理论 .............................................................................................................. 10

2.2.1 产业集群理论 ............................................................................................... 10

2.2.2 供应链管理理论 ........................................................................................... 10

2.2.3 协同理论 ....................................................................................................... 10

2.2.4 自偿性贸易融资理论 .....................................................................................11

2.3 本章小结 .............................................................................................................. 11

第三章 农业供应链金融发展现状及存在问题 .......................................................... 12

1.1 农业供应链金融的发展过程及现状 .................................................................. 12

3.1.1 供应链金融的实践 ....................................................................................... 12

3.1.2 农业供应链金融的发展 ............................................................................... 18

3.2 农业供应链金融的运作机制 .............................................................................. 18

3.2.1 目标市场与客户 ............................................................................................ 18

3.2.2 业务模式 ....................................................................................................... 19

3.3 农业供应链金融存在的问题 .............................................................................. 22

3.3.1 大数据经营问题 ........................................................................................... 22

3.3.2 供应链模式及主导企业选择问题 ............................................................... 23

3.3.3 风险管控和收益分配问题 ........................................................................... 23

3.3.4 其他问题 ....................................................................................................... 24

3.4 本章小结 .............................................................................................................. 24

第四章 农业供应链的大数据经营及风险管控 .......................................................... 25

4.1 农业大数据应用机遇分析 .................................................................................. 25

4.1.1 大数据在农业领域的应用 ........................................................................... 25

4.1.2 大数据在农业供应链金融实时场景中的优势 ........................................... 26

4.2 农业大数据经营平台构建流程及难点 .............................................................. 26

4.2.1 数据采集 ....................................................................................................... 26

4.2.2 数据存储及预处理 ....................................................................................... 27

4.2.3 数据挖掘分析 ............................................................................................... 27

4.2.4 数据解释 ....................................................................................................... 28

4.3 大数据视角下农业供应链金融风险管控 .......................................................... 29

4.3.1 大数据在国内外风险管控中的实践 ........................................................... 29

4.3.2 大数据在农业供应链金融风险管控中的应用 ........................................... 30

4.3.3 大数据视角下农业供应链风险管控模型 ................................................... 31

4.4 上海市农业供应链金融大数据信息平台构思 .................................................. 32

4.4.1 Hadoop 集群在农业大数据平台适用性分析............................................... 32

4.3.2 上海市农业供应链金融平台搭建 ............................................................... 33

4.4 本章小结 .............................................................................................................. 34

第五章 农业供应链金融收益分配及主导企业选择 .................................................. 35

5.1 上海市农业供应链金融发展模式选择 .............................................................. 35

5.1.1 超市主导型农业供应链金融模式 ............................................................... 35

5.1.2 核心企业主导型农业供应链金融模式 ....................................................... 36

5.1.3 第三方物流企业主导型农业供应链金融模式 ........................................... 37

5.1.4 批发市场主导型农业供应链金融模式 ....................................................... 39

5.1.5 农民合作组织主导型农业供应链金融模式 ............................................... 40

5.1.6 上海市农业供应链金融的发展模式选择 .................................................... 41

5.2 核心企业主导的农业供应链金融收益分配机制研究 ...................................... 42

5.2.1 Shapley 值法模型定义 .................................................................................. 43

5.2.2 Shapley 值法在核心企业主导的农业供应链金融模式中的应用 .............. 43

5.3 案例-上海市生猪产业链核心企业选择与评估 ................................................. 45

5.3.1 上海市生猪产业链发展概况 ....................................................................... 45

5.3.2 大数据视角下生猪产业链中核心企业选择 ............................................... 46

5.4 本章小结 .............................................................................................................. 56

第六章 结论 .................................................................................................................. 58

参考文献 ........................................................................................................................ 60

在读期间公开发表的论文和承担科研项目及取得成果 ............................................ 63

致谢 ................................................................................................................................ 64

附录 ................................................................................................................................ 65

相关推荐

-

【拔高测试】沪教版数学五年级下册期末总复习(含答案)VIP免费

2024-11-19 13

2024-11-19 13 -

【基础卷】小学数学五年级下册期末小升初试卷四(沪教版,含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

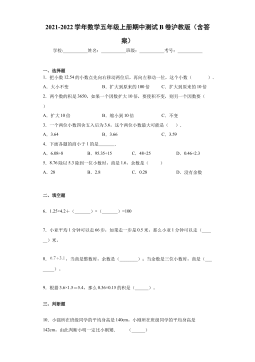

期中测试B卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

期中测试B卷(试题)- 2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 10

2024-11-19 10 -

期中测试A卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 14

2024-11-19 14 -

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 15

2024-11-19 15 -

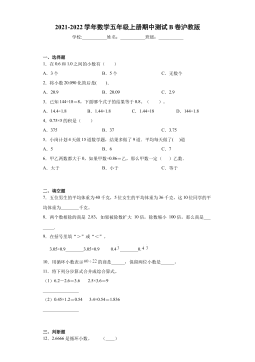

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 11

2024-11-19 11 -

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 22

2024-11-19 22 -

【七大类型简便计算狂刷题】四下数学+答案

2025-03-18 6

2025-03-18 6 -

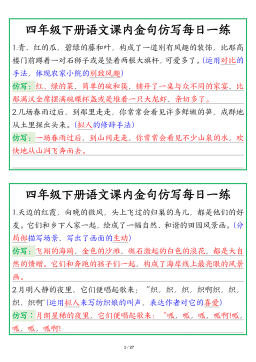

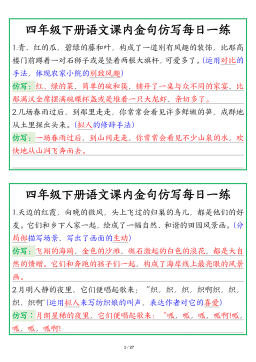

【课内金句仿写每日一练】四下语文

2025-03-18 6

2025-03-18 6

作者:侯斌

分类:高等教育资料

价格:15积分

属性:77 页

大小:3.63MB

格式:PDF

时间:2025-01-09

相关内容

-

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【七大类型简便计算狂刷题】四下数学+答案

分类:中小学教育资料

时间:2025-03-18

标签:数学计算;校内数学

格式:PDF

价格:1 积分

-

【课内金句仿写每日一练】四下语文

分类:中小学教育资料

时间:2025-03-18

标签:无

格式:PDF

价格:1 积分