中国证券市场稳定价格波动的交易制度研究

摘要股价波动性是衡量一个证券市场成熟与否的重要指标,而一个证券市场所采用的交易制度则是影响该市场股价波动性的一个重要因素,这也是近来学术界研究的热点问题。本文以前人在此方面的研究为基础,首先从理论上对我国证券市场上所采用的稳定价格交易制度:集合竞价制度、涨跌幅限制制度和T+1制度进行分析,并选用了这些制度变化前后股票价格的变化数据进行统计分析,得出结论:1在第一次我国由连续竞价制度改为集合竞价制度产生开盘价之后,集合竞价制度发在稳定价格波动方面发挥了作用,但由封闭式的集合竞价制度变更为开放式集合竞价制度后,并没有如期望的较之前在稳定价格方面作用明显;2数据统计分析表明,幅度为10%的涨跌幅限制...

相关推荐

-

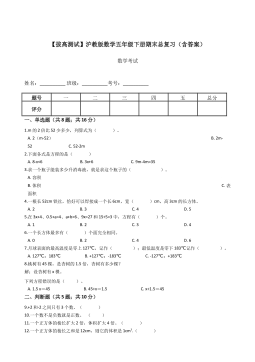

【拔高测试】沪教版数学五年级下册期末总复习(含答案)VIP免费

2024-11-19 13

2024-11-19 13 -

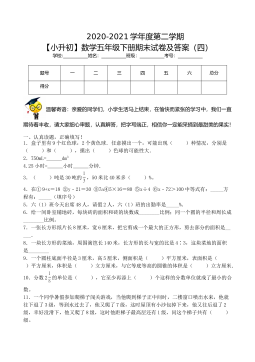

【基础卷】小学数学五年级下册期末小升初试卷四(沪教版,含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

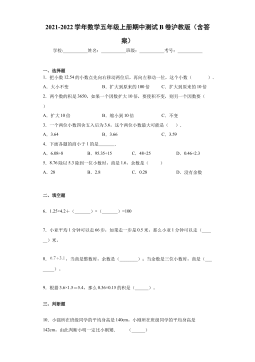

期中测试B卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

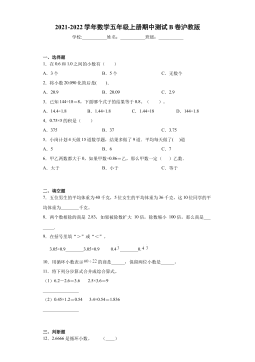

期中测试B卷(试题)- 2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 10

2024-11-19 10 -

期中测试A卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 14

2024-11-19 14 -

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 15

2024-11-19 15 -

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 11

2024-11-19 11 -

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 22

2024-11-19 22 -

【七大类型简便计算狂刷题】四下数学+答案

2025-03-18 6

2025-03-18 6 -

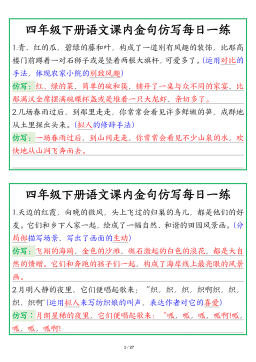

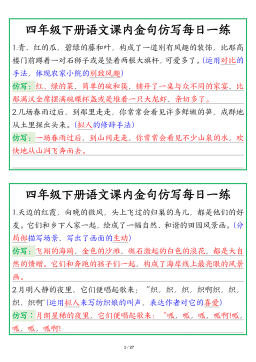

【课内金句仿写每日一练】四下语文

2025-03-18 6

2025-03-18 6

相关内容

-

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【七大类型简便计算狂刷题】四下数学+答案

分类:中小学教育资料

时间:2025-03-18

标签:数学计算;校内数学

格式:PDF

价格:1 积分

-

【课内金句仿写每日一练】四下语文

分类:中小学教育资料

时间:2025-03-18

标签:无

格式:PDF

价格:1 积分