中小企业关系型融资效率研究

摘要2008年,金融风暴席卷全球,全世界都不同程度上遭受了损失,而我国正处于经济转轨的特殊时期,国内中小金融机构在这次风暴中首当其冲,更是有许多的外贸加工型中小企业面临破产倒闭。2009年,我国经济率先回暖,中小企业发展开始复苏,而由于我国现存的经济体制和市场状态,中小企业的发展明显面临严重的资金支持,中小企业的融资难是摆在我们面前最现实的最紧迫的问题。关系型融资的研究是近年来西方经济学研究的重点领域和热点问题,我国目前关系型融资的研究仍处于初期阶段,基本上还是翻译西方或日本的一些经济理论和基本模型及框架结构,缺少理论上的创新和实践上的研究。从融资模式的信息生产方式来看,在公开市场融资模式下,...

相关推荐

-

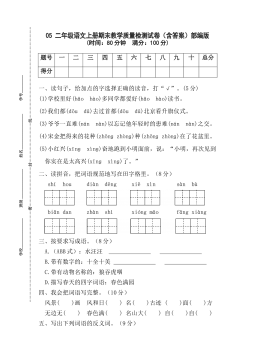

5 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 11

2024-11-19 11 -

4 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 11

2024-11-19 11 -

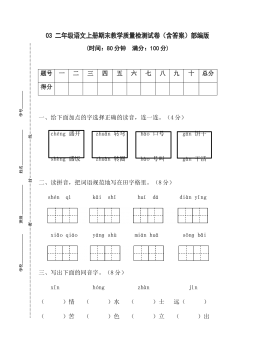

3 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 11

2024-11-19 11 -

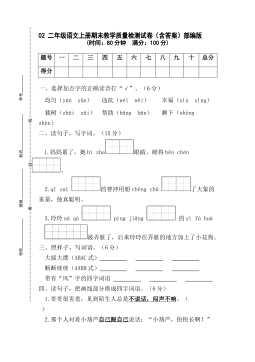

2 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 10

2024-11-19 10 -

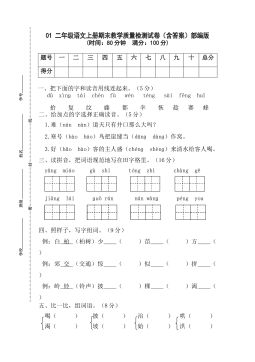

1二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 11

2024-11-19 11 -

【满分冲刺】2021-2022学年二年级语文上册期末考试尖子生突破卷 部编版(含答案)VIP免费

2024-11-19 13

2024-11-19 13 -

【精品】二年级上册语文试题-期中考试模拟卷-部编版(含答案)VIP免费

2024-11-19 13

2024-11-19 13 -

【冲刺百分】二年语文上册期末冲刺模拟试卷(B) (有答案)VIP免费

2024-11-19 12

2024-11-19 12 -

【冲刺百分】二年语文上册期末冲刺模拟试卷(A) (有答案)VIP免费

2024-11-19 11

2024-11-19 11 -

第六单元试题(B)二年级上册语文(部编含答案)VIP免费

2024-11-19 15

2024-11-19 15

相关内容

-

【满分冲刺】2021-2022学年二年级语文上册期末考试尖子生突破卷 部编版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分

-

【精品】二年级上册语文试题-期中考试模拟卷-部编版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分

-

【冲刺百分】二年语文上册期末冲刺模拟试卷(B) (有答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【冲刺百分】二年语文上册期末冲刺模拟试卷(A) (有答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

第六单元试题(B)二年级上册语文(部编含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分