中小企业信贷系统的运行模式研究

摘要随着我国市场经济体制的不断发展与完善,中小企业在稳定和促进经济发展方面的作用日益显现,同时也得到了越来越多的重视。我国政府和相关金融机构多次公开强调社会要支持中小企业的发展,中小企业发展的瓶颈——中小企业融资难问题开始被社会所关注。受我国历史发展和社会环境的约束,银行信贷仍是目前中小企业外部资金来源的主要渠道。但由于受社会经济环境的影响,我国中小企业一般基础较为薄弱,技术与管理水平比较落后,经营风险相对较高,银行扩大对中小企业的资金支持将面临信贷风险提高等一系列问题。如何高效的满足中小企业的资金需求,又能对银行的信贷风险进行有效的控制,自然就成了本文的研究课题——中小企业信贷系统的运行模式...

相关推荐

-

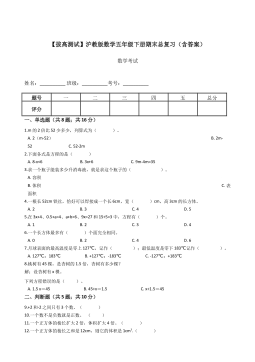

【拔高测试】沪教版数学五年级下册期末总复习(含答案)VIP免费

2024-11-19 13

2024-11-19 13 -

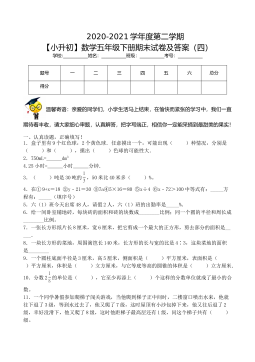

【基础卷】小学数学五年级下册期末小升初试卷四(沪教版,含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

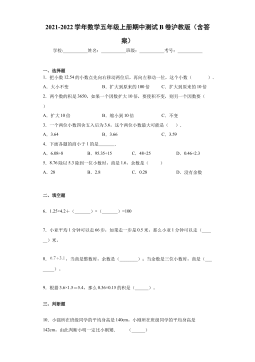

期中测试B卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

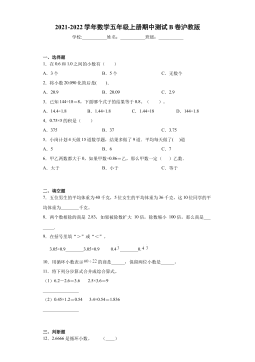

期中测试B卷(试题)- 2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 10

2024-11-19 10 -

期中测试A卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 14

2024-11-19 14 -

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 15

2024-11-19 15 -

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 11

2024-11-19 11 -

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 22

2024-11-19 22 -

【七大类型简便计算狂刷题】四下数学+答案

2025-03-18 6

2025-03-18 6 -

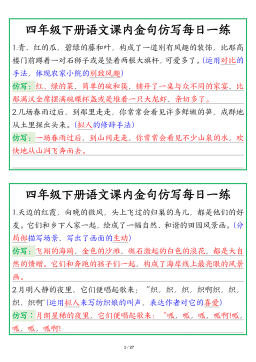

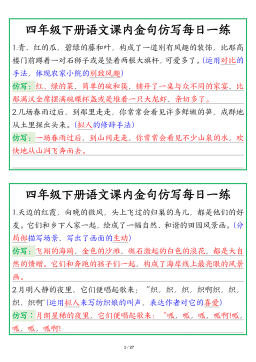

【课内金句仿写每日一练】四下语文

2025-03-18 6

2025-03-18 6

相关内容

-

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【七大类型简便计算狂刷题】四下数学+答案

分类:中小学教育资料

时间:2025-03-18

标签:数学计算;校内数学

格式:PDF

价格:1 积分

-

【课内金句仿写每日一练】四下语文

分类:中小学教育资料

时间:2025-03-18

标签:无

格式:PDF

价格:1 积分