初始排污权定价模型研究

摘要与传统环境管理手段相比,排污权交易制度由于不但兼具质量保障与成本效益等诸多优点,而且在国外已有三十多年的成功实践经验。排污权交易制度目前已成为各国竞相仿效的环境经济政策,其相关议题也是学术界与政策制定者研究的热点。然而,初始排污权定价问题的研究却很有限,尚未形成市场化的价格形成机制。初始排污权定价理论还处于探索阶段,实际交易价格多低于污染治理价格,没有体现出排污权这种环境资源的稀缺性,定价人为因素为主,波动大。一种合理的排污权初始分配、交易制度以及科学合理的排污权定价机制,是影响排污权市场表现的重要因素,它们很大程度上决定了排污权交易的市场总量和活跃程度。构建有效的排污权价格形成机制与运行...

相关推荐

-

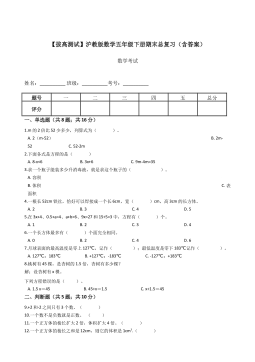

【拔高测试】沪教版数学五年级下册期末总复习(含答案)VIP免费

2024-11-19 19

2024-11-19 19 -

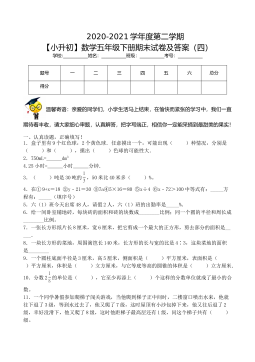

【基础卷】小学数学五年级下册期末小升初试卷四(沪教版,含答案)VIP免费

2024-11-19 9

2024-11-19 9 -

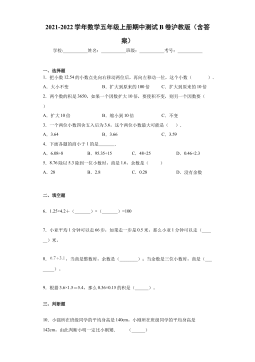

期中测试B卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 11

2024-11-19 11 -

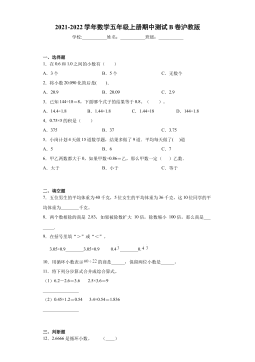

期中测试B卷(试题)- 2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 16

2024-11-19 16 -

期中测试A卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 18

2024-11-19 18 -

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 25

2024-11-19 25 -

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 23

2024-11-19 23 -

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 31

2024-11-19 31 -

【七大类型简便计算狂刷题】四下数学+答案

2025-03-18 16

2025-03-18 16 -

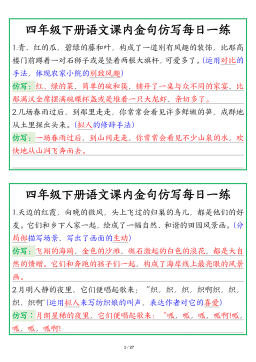

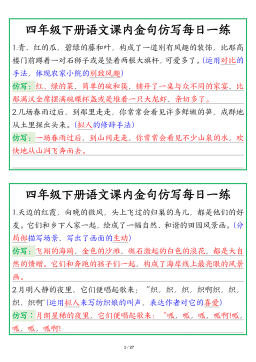

【课内金句仿写每日一练】四下语文

2025-03-18 39

2025-03-18 39

相关内容

-

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【七大类型简便计算狂刷题】四下数学+答案

分类:中小学教育资料

时间:2025-03-18

标签:数学计算;校内数学

格式:PDF

价格:1 积分

-

【课内金句仿写每日一练】四下语文

分类:中小学教育资料

时间:2025-03-18

标签:无

格式:PDF

价格:1 积分