公司债融资偏好与融资效率研究

摘要针对2007年8月《公司债发行试点法》出台后,上市公司可用融资渠道得以拓宽情形下,陆续出现规模庞大的公司债发行潮这一现象。本文试结合实证分析研究了《试点办法》发行前后的融资偏好与融资效率,发现我国融资出现逐渐偏好债权融资的趋势,这一趋势的变化渐与西方经典的融资理论一致。本文借助MSExcel的Web数据导入功能;结合ExcelVBA宏编程功能,设计了批量自动导入,批量格式转换,批量数据抽取脚本;方便快速的采集到了115个上市公司、21个季(年)报、各6个数据区块类别的财务数据。由此无需采购专业金融数据库,即能取得可供研究的样本数据。通过样本数据分析找到了公司行业类别、市场资金状况、公司规模...

相关推荐

-

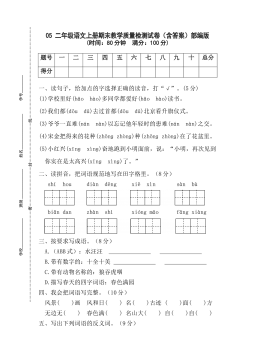

5 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 12

2024-11-19 12 -

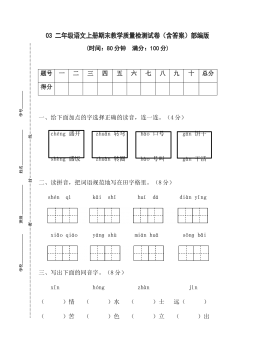

4 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 40

2024-11-19 40 -

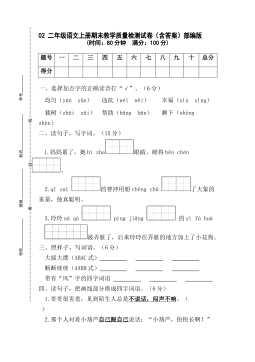

3 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 20

2024-11-19 20 -

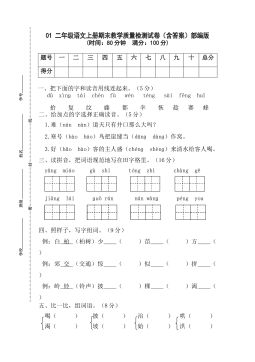

2 二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 29

2024-11-19 29 -

1二年级语文上册期末教学质量检测试卷(含答案)部编版VIP免费

2024-11-19 16

2024-11-19 16 -

【满分冲刺】2021-2022学年二年级语文上册期末考试尖子生突破卷 部编版(含答案)VIP免费

2024-11-19 75

2024-11-19 75 -

【精品】二年级上册语文试题-期中考试模拟卷-部编版(含答案)VIP免费

2024-11-19 80

2024-11-19 80 -

【冲刺百分】二年语文上册期末冲刺模拟试卷(B) (有答案)VIP免费

2024-11-19 23

2024-11-19 23 -

【冲刺百分】二年语文上册期末冲刺模拟试卷(A) (有答案)VIP免费

2024-11-19 16

2024-11-19 16 -

第六单元试题(B)二年级上册语文(部编含答案)VIP免费

2024-11-19 20

2024-11-19 20

相关内容

-

【满分冲刺】2021-2022学年二年级语文上册期末考试尖子生突破卷 部编版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分

-

【精品】二年级上册语文试题-期中考试模拟卷-部编版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分

-

【冲刺百分】二年语文上册期末冲刺模拟试卷(B) (有答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【冲刺百分】二年语文上册期末冲刺模拟试卷(A) (有答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

第六单元试题(B)二年级上册语文(部编含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分