环渤海地区金融成长差异实证研究

I摘要金融是现代经济的核心,理论和实践都表明,区域经济的振兴离不开区域金融的发展,区域金融是促进区域经济发展的重要因素。开发环渤海地区需要其金融体系的支持,而环渤海地区金融发展水平的相对落后和不均衡,在一定程度上阻碍了环渤海地区经济的进一步发展。因此,对于环渤海地区金融成长差异进行实证描述和深入研究是十分重要和必要的。本文在古典经济学中对资本的论述、区域经济学理论、金融发展理论以及区域金融理论的基础上构建了环渤海地区金融成长差异实证研究的分析框架。在大量理论铺垫和收集数据的前提下,本文对环渤海地区的区域金融发展指标、区域金融结构指标、区域金融成长差异的行业比较以及环渤海地区金融综合竞争力计量指...

相关推荐

-

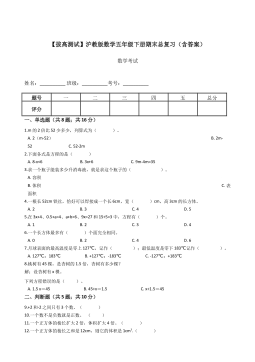

【拔高测试】沪教版数学五年级下册期末总复习(含答案)VIP免费

2024-11-19 13

2024-11-19 13 -

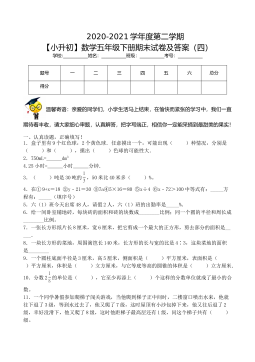

【基础卷】小学数学五年级下册期末小升初试卷四(沪教版,含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

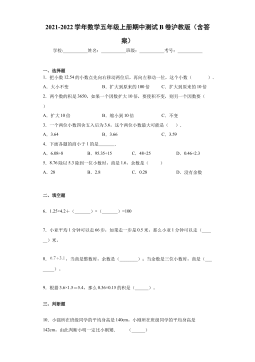

期中测试B卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

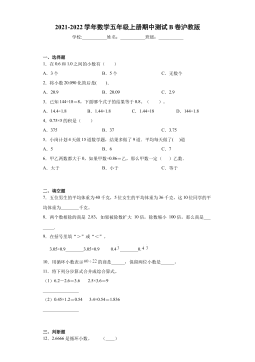

期中测试B卷(试题)- 2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 10

2024-11-19 10 -

期中测试A卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 14

2024-11-19 14 -

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 15

2024-11-19 15 -

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 11

2024-11-19 11 -

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 22

2024-11-19 22 -

【七大类型简便计算狂刷题】四下数学+答案

2025-03-18 6

2025-03-18 6 -

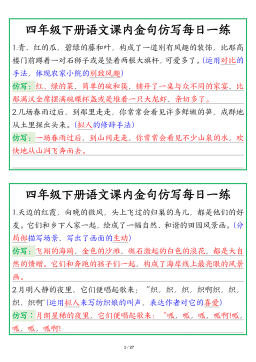

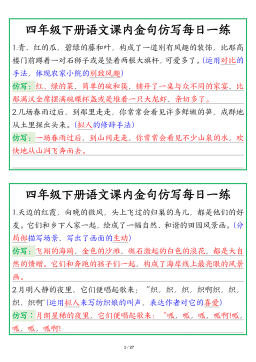

【课内金句仿写每日一练】四下语文

2025-03-18 6

2025-03-18 6

相关内容

-

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【七大类型简便计算狂刷题】四下数学+答案

分类:中小学教育资料

时间:2025-03-18

标签:数学计算;校内数学

格式:PDF

价格:1 积分

-

【课内金句仿写每日一练】四下语文

分类:中小学教育资料

时间:2025-03-18

标签:无

格式:PDF

价格:1 积分