基于经济周期的项目投融资非预期风险评价及策略研究

摘要在当今之社会,一切都是项目,一切也将成为项目1。项目管理是当今急剧变化时代求得生存的关键。项目的投融资策略是项目管理的重要的核心内容。始于20世纪90年代的项目风险管理是现代项目管理的一个非常重要的课题。由于项目的一次性和独特性使得项目的风险远远大于一般日常运营中的风险,因此要想保障项目的成功就必须开展项目的风险管理。特别对于那些投资周期长、投入金额大、易受外界因素影响、灵活性又差的项目,尤其是关系到国计民生的投资项目,其投资过程涉及到社会、民生、经济、金融、技术等各个方面,在发展过程中会受到诸多不确定因素的影响。特别是在影响经济周期的因素下所引发的非预期风险相对于可预期风险来说,影响投融...

相关推荐

-

人教PEP英语-((开学摸底测试 综合提升卷)2023-2024学年五年级英语上册开学摸底考试卷(一)(人教PEP版)VIP免费

2024-09-30 10

2024-09-30 10 -

人教PEP英语-((开学摸底测试 重难点必刷卷)2023-2024学年四年级英语上册开学摸底考试卷(二)(人教PEP版)VIP免费

2024-09-30 11

2024-09-30 11 -

人教PEP英语-((开学摸底测试 重难点必刷卷)2023-2024学年五年级英语上册开学摸底考试卷(二)(人教PEP版)VIP免费

2024-09-30 10

2024-09-30 10 -

人教PEP英语-((开学摸底测试 综合提升卷)2023-2024学年四年级英语上册开学摸底考试卷(一)(人教PEP版)VIP免费

2024-09-30 10

2024-09-30 10 -

人教PEP英语-(2023-2024学年六年级英语上册开学摸底考试卷A卷(人教PEP版)VIP免费

2024-09-30 8

2024-09-30 8 -

人教PEP英语-(2023-2024学年六年级英语上册开学摸底考试卷B卷(人教PEP版)VIP免费

2024-09-30 8

2024-09-30 8 -

人教PEP英语-(开学摸底测试 易错题精选卷)2023-2024学年五年级英语上册开学摸底考试卷(三)(人教PEP版)VIP免费

2024-09-30 8

2024-09-30 8 -

外研版英语-(开学摸底测试 易错题精选卷)2023-2024学年六年级英语上册开学摸底考试卷(三)(外研版三起)VIP免费

2024-09-30 8

2024-09-30 8 -

外研版英语-(开学摸底测试 易错题精选卷)2023-2024学年五年级英语上册开学摸底考试卷(三)(外研版三起)VIP免费

2024-09-30 8

2024-09-30 8 -

外研版英语-(开学摸底测试 重难点必刷卷)2023-2024学年六年级英语上册开学摸底考试卷(二)(外研版三起)VIP免费

2024-09-30 8

2024-09-30 8

相关内容

-

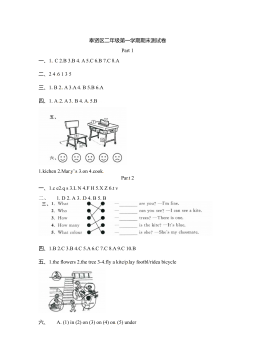

2019-2020学年2年级松江区英语上期末试卷答案

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

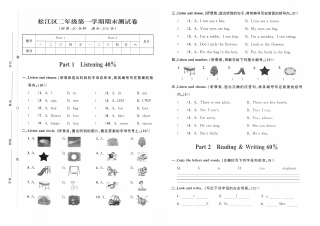

2019-2020学年2年级松江区英语上期末试卷

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:PDF

价格:5 积分

-

2019-2020学年2年级奉贤区英语上期末试卷答案

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

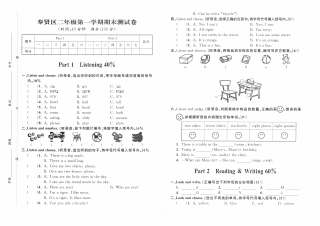

2019-2020学年2年级奉贤区英语上期末试卷

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:PDF

价格:5 积分

-

2021-2022学年牛津上海版(试用本)二年级上册期中模拟测试英语试卷(原卷版)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOC

价格:5 积分