具有特殊经济地位城市的房地产市场发展---上海房地产业发展与宏观调控的相关性研究

摘要房地产业作为国民经济发展提供生活资料和生产资料的基础性产业,是反映人民生活水平和社会经济发展状态的重要标志性产业之一。政府对房地产业的宏观调控,在保持基本供求的基础上,能促使房价稳定上涨。上海作为长三角经济圈的龙头城市,其特殊的经济地位是不言而喻的。上海房地产业的发展在90年代后期日益蓬勃起来,目前,已经成为了上海经济的支柱产业。本文将着重于上海房地产业发展与政府宏观调控的相关性的基础研究。全文主要从四个方面进行论述:一是,阐述“龙头”上海的特殊经济地位,近年上海与长三角其他城市房地产发展的概况;二是,研究政府宏观调控房地产业的各项政策,并回顾研究发达国家、地区房地产发展的经验、规律和教训...

相关推荐

-

南京监狱罪犯危机干预系统评估报告VIP免费

2024-10-15 6

2024-10-15 6 -

中国政府采购制度研究VIP免费

2024-10-15 9

2024-10-15 9 -

政府采购运行效率要素分析VIP免费

2024-10-15 7

2024-10-15 7 -

政府采购效率浅析VIP免费

2024-10-15 7

2024-10-15 7 -

政府采购的效率从何而来VIP免费

2024-10-15 7

2024-10-15 7 -

正确的政府采购效率观VIP免费

2024-10-15 6

2024-10-15 6 -

影响政府采购效率的因素分析及对策VIP免费

2024-10-15 7

2024-10-15 7 -

影响政府采购效率的几个因素及解决措施VIP免费

2024-10-15 8

2024-10-15 8 -

学好政府采购法_提高中央国家机关单位政府采购工作效率VIP免费

2024-10-15 13

2024-10-15 13 -

完善政府采购法规提高政府采购效率VIP免费

2024-10-15 18

2024-10-15 18

相关内容

-

创青春-公益创业赛项目书

分类:行业资料

时间:2025-01-09

标签:无

格式:DOCX

价格:10 积分

-

茶文化-剪纸公益项目计划书

分类:行业资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

xxx公益创业大赛策划书

分类:行业资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

“筑爱助残-共享阳光”公益项目说明书

分类:行业资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

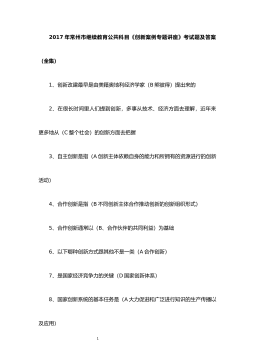

2017 常州市继续教育公共《创新案例专题讲座》考题

分类:行业资料

时间:2025-03-06

标签:2017 常州 继续教育 公共 创新案例专题讲座

格式:DOCX

价格:5 积分