人民币实际汇率与我国贸易收支——基于中美双边数据的实证分析

摘要2002年以来,国际社会要求人民币升值的呼声不断高涨,特别是美国为了扭转其对华的巨额贸易逆差,强烈要求人民币对美元升值。2005年7月21日,中国人民银行宣布,我国将实行以市场供求为基础、参考一篮子货币进行调节,有管理的浮动汇率制度。同时宣布美元对人民币交易价格调整为1美元兑8.11元人民币,升值约2个百分点。在这样的背景下,理论率与我国贸易收支关系的关界对人民币实际汇注开始升温,很多学者担心人民币汇率升值将会给我国贸易收支带来严重冲击,进而影响我国国民经济的稳定。上述判断正确与否,基于我们对以下问题的我国贸回答:人民币实际汇率变动对我国贸易收支的作用机制;人民币实际汇率变动对易收支影响的...

相关推荐

-

XX中学英语学科质量提升计划书VIP免费

2025-01-09 8

2025-01-09 8 -

VIPKID-美国小学在家上-在线英语学习项目商业计划书VIP免费

2025-01-09 8

2025-01-09 8 -

English TV--英语学习智能视频平台创业商业计划书VIP免费

2025-01-09 11

2025-01-09 11 -

English TV,4--英语学习智能视频平台商业计划书VIP免费

2025-01-09 14

2025-01-09 14 -

260Educotton-让孩子快乐学习英语的平板电脑商业计划书VIP免费

2025-01-09 12

2025-01-09 12 -

XX英语学校创业策划书VIP免费

2025-01-09 11

2025-01-09 11 -

Ustudy-K12英语在线学习产品商业计划书VIP免费

2025-01-09 12

2025-01-09 12 -

Strawberry English School (SES)英语培训学校计划书VIP免费

2025-01-09 16

2025-01-09 16 -

《天中英语智能电子公司创业商业计划书》VIP免费

2025-01-09 13

2025-01-09 13 -

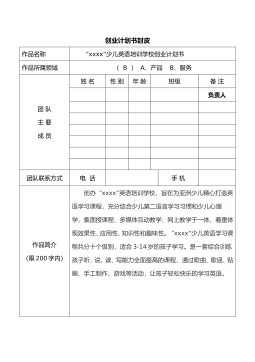

XXXX少儿英语培训学校创业计划书VIP免费

2025-01-09 21

2025-01-09 21

相关内容

-

XX英语学校创业策划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:WPS

价格:10 积分

-

Ustudy-K12英语在线学习产品商业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:PPTX

价格:10 积分

-

Strawberry English School (SES)英语培训学校计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

《天中英语智能电子公司创业商业计划书》

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

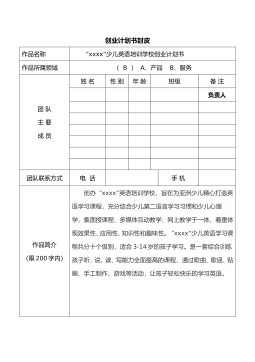

XXXX少儿英语培训学校创业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分