我国金融衍生品演进路径探析

摘要金融衍生品产生于20世纪70年代,是出于风险管理的需求。到了90年代随着金融创新的日新月异,金融衍生品成为金融市场上当然不让的新贵,但衍生品过度膨胀到了2008年最终触发了一场始料未及的全球性金融危机。不能说金融衍生品是金融危机的罪魁祸首,但金融衍生品在这场危机中却扮演着火上浇油的角色。中国是一个新兴市场经济国家,目前的衍生品市场只有规模有限的商品期货,我们不能因为金融危机就否认金融衍生品的积极作用,而是应该从这场危机中吸取经验教训,总结经验,不断完善市场建设基础,规划出一条适合我国国情的金融衍生品市场发展路径。本文首先对金融衍生品概念、金融衍生品的分类和特点进行界定,为金融衍生品的研究提...

相关推荐

-

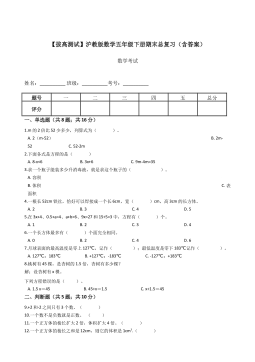

【拔高测试】沪教版数学五年级下册期末总复习(含答案)VIP免费

2024-11-19 13

2024-11-19 13 -

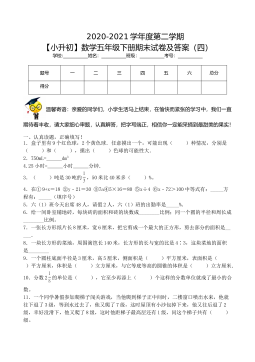

【基础卷】小学数学五年级下册期末小升初试卷四(沪教版,含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

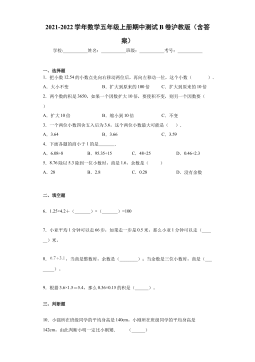

期中测试B卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 8

2024-11-19 8 -

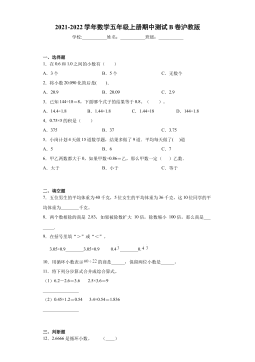

期中测试B卷(试题)- 2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 10

2024-11-19 10 -

期中测试A卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 14

2024-11-19 14 -

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 15

2024-11-19 15 -

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)VIP免费

2024-11-19 11

2024-11-19 11 -

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)VIP免费

2024-11-19 22

2024-11-19 22 -

【七大类型简便计算狂刷题】四下数学+答案

2025-03-18 6

2025-03-18 6 -

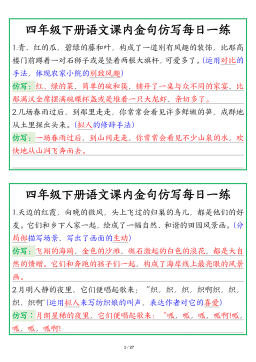

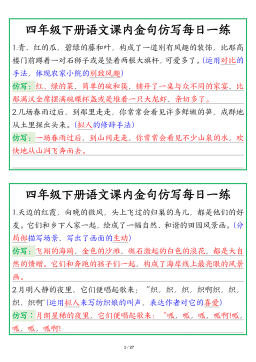

【课内金句仿写每日一练】四下语文

2025-03-18 6

2025-03-18 6

相关内容

-

期中测试A卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测B试卷(试题)-2021-2022学年数学五年级上册 沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

期中测A试卷(试题)-2021-2022学年数学五年级上册沪教版(含答案)

分类:中小学教育资料

时间:2024-11-19

标签:无

格式:DOCX

价格:5 积分

-

【七大类型简便计算狂刷题】四下数学+答案

分类:中小学教育资料

时间:2025-03-18

标签:数学计算;校内数学

格式:PDF

价格:1 积分

-

【课内金句仿写每日一练】四下语文

分类:中小学教育资料

时间:2025-03-18

标签:无

格式:PDF

价格:1 积分