我国开放式股票型基金的绩效研究

摘要近几年我国的开放式股票型基金无论规模还是市场影响力都走进了新阶段,以开放式股票型基金为主力的基金机构投资者已经与保险机构投资者、社保基金构成中国资本市场的主要机构投资者,与此同时,开放式股票型基金的业绩也伴随着近年来特点鲜明的股票市场走势表现出阶段特点。长远来看,经风险调整的基金业绩评价体系将更有利于我国开放式股票型基金健康有序的成长,正越来越多的受到基金公司的重视,监管层的关注和投资者的理解。本文借助已有经风险调整基金业绩评价理论,依托市场特点对近三年来的开放式股票型基金业绩情况按照牛、熊市特征进行考察期划分,并采用阶段对比分析。在实证研究中,从定量分析和定性分析出发,样本基金选取上,力...

相关推荐

-

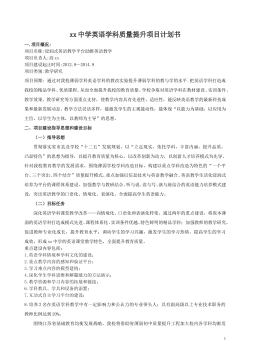

XX中学英语学科质量提升计划书VIP免费

2025-01-09 8

2025-01-09 8 -

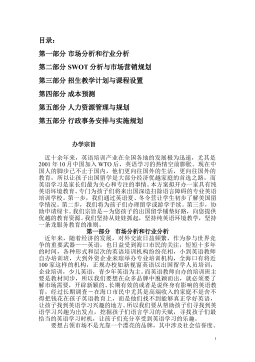

VIPKID-美国小学在家上-在线英语学习项目商业计划书VIP免费

2025-01-09 8

2025-01-09 8 -

English TV--英语学习智能视频平台创业商业计划书VIP免费

2025-01-09 11

2025-01-09 11 -

English TV,4--英语学习智能视频平台商业计划书VIP免费

2025-01-09 14

2025-01-09 14 -

260Educotton-让孩子快乐学习英语的平板电脑商业计划书VIP免费

2025-01-09 12

2025-01-09 12 -

XX英语学校创业策划书VIP免费

2025-01-09 11

2025-01-09 11 -

Ustudy-K12英语在线学习产品商业计划书VIP免费

2025-01-09 12

2025-01-09 12 -

Strawberry English School (SES)英语培训学校计划书VIP免费

2025-01-09 16

2025-01-09 16 -

《天中英语智能电子公司创业商业计划书》VIP免费

2025-01-09 13

2025-01-09 13 -

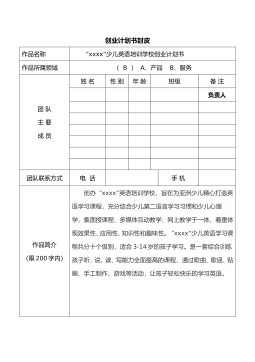

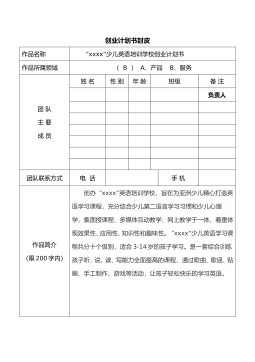

XXXX少儿英语培训学校创业计划书VIP免费

2025-01-09 21

2025-01-09 21

相关内容

-

XX英语学校创业策划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:WPS

价格:10 积分

-

Ustudy-K12英语在线学习产品商业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:PPTX

价格:10 积分

-

Strawberry English School (SES)英语培训学校计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

《天中英语智能电子公司创业商业计划书》

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分

-

XXXX少儿英语培训学校创业计划书

分类:中小学教育资料

时间:2025-01-09

标签:无

格式:DOC

价格:10 积分