我国区域金融发展与区域经济增长

摘要经济增长和金融发展的关系研究属于经济学界倍受关注的课题,本文运用区域经济学、金融学和经济增长理论,使用规范分析与实证分析相结合的研究方法,通过对我国区域金融发展与经济增长理论的分析和实证研究,揭示了在一定的经济发展阶段,区域金融发展与经济增长呈现出相互促进、相互影响的关系。改革开放以来,中国的经济迅速发展,取得了举世瞩目的巨大成就。但是地区间的金融发展及经济增长差距却越来越大。如何缩小地区间的经济发展差距,实现我国地区经济的协调发展,是我国政府必须解决的难题之一。本文在结构上分为五章:第一章绪论部分主要阐述本文选题的理论与现实意义及介绍国内外目前对此课题的研究现状,阐明了本文的研究方法及研...

相关推荐

-

THE COLOR FACTORY ——色彩心理康复体验中心设计VIP免费

2024-09-24 13

2024-09-24 13 -

中英大学生创业教育参与主体比较研究VIP免费

2024-09-30 58

2024-09-30 58 -

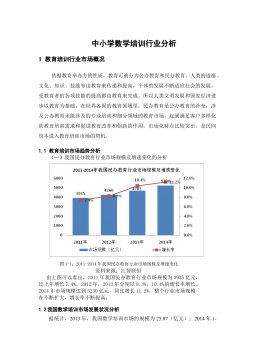

中小学数学培训行业分析VIP免费

2024-09-30 21

2024-09-30 21 -

英国大学生创业教育保障体系及其经验借鉴VIP免费

2024-09-30 67

2024-09-30 67 -

我国大学生创业教育的现状问题及对策研究VIP免费

2024-09-30 41

2024-09-30 41 -

浅谈大学生创业教育中加强思想政治工作的对策问题VIP免费

2024-09-30 23

2024-09-30 23 -

关于我国大学生创业教育目标定位的思考VIP免费

2024-09-30 71

2024-09-30 71 -

大学生创业教育引入SIYB项目的分析研究VIP免费

2024-09-30 57

2024-09-30 57 -

大学生创业教育对策研究VIP免费

2024-09-30 53

2024-09-30 53 -

大学生创业教育存在的问题及对策浅析VIP免费

2024-09-30 65

2024-09-30 65

相关内容

-

中英大学生创业教育参与主体比较研究

分类:高等教育资料

时间:2024-09-30

标签:无

格式:PDF

价格:12 积分

-

中小学数学培训行业分析

分类:高等教育资料

时间:2024-09-30

标签:无

格式:DOCX

价格:12 积分

-

英国大学生创业教育保障体系及其经验借鉴

分类:高等教育资料

时间:2024-09-30

标签:无

格式:PDF

价格:12 积分

-

大学生创业教育对策研究

分类:高等教育资料

时间:2024-09-30

标签:无

格式:PDF

价格:12 积分

-

浅析大学生创业教育内容体系和模式

分类:高等教育资料

时间:2024-09-30

标签:无

格式:PDF

价格:12 积分