我国中小企业供应链金融的系统仿真研究及风险评价

摘要传统的银行信贷模式,已经不能满足新时代下中小企业的发展对融资的需求,供应链金融这一新模式应运而生。供应链金融以供应链管理为背景,为中小企业融资拓宽了渠道,同时提高了供应链的整体竞争力,开拓了银行信贷业务的新领域。广义的供应链金融管理就是对供应链中一切涉及资金流的活动进行协调管理,是银行对供应链内部交易结构进行分析的基础上,加入核心企业、物流企业和资金流导引等风险控制变量,对供应链的不同节点提供封闭授信和结算、理财等综合金融服务。狭义的范畴可以理解为供应链授信,即供应链融资。我国现有的研究主要针对它的狭义范畴。许多企业和银行也就其中的某一些融资业务模式展开了实践应用。本文从系统科学的角度,研...

相关推荐

-

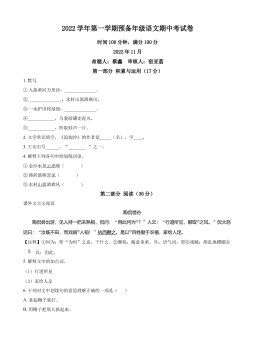

上海市回民中学2022-2023学年(五四学制)六年级上学期期中语文试题(原卷版)VIP免费

2024-09-24 9

2024-09-24 9 -

上海市回民中学2022-2023学年(五四学制)六年级上学期期中语文试题(解析版)VIP免费

2024-09-24 9

2024-09-24 9 -

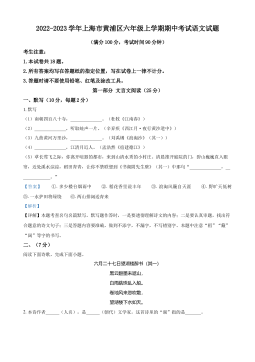

上海市黄浦区2022-2023学年(五四学制)六年级上学期期中语文试题(原卷版)VIP免费

2024-09-24 7

2024-09-24 7 -

上海市黄浦区2022-2023学年(五四学制)六年级上学期期中语文试题(解析版)VIP免费

2024-09-24 7

2024-09-24 7 -

上海市长宁区2020-2021学年六年级上学期期末语文试题(原卷版)VIP免费

2024-09-30 19

2024-09-30 19 -

上海市长宁区2020-2021学年六年级上学期期末语文试题(解析版)VIP免费

2024-09-30 9

2024-09-30 9 -

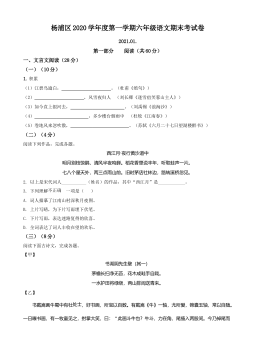

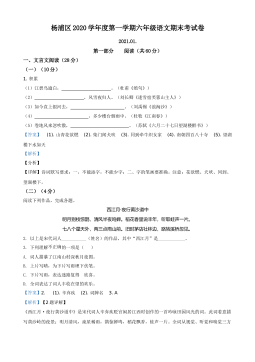

上海市杨浦区2020-2021学年六年级上学期期末语文试题(原卷版)VIP免费

2024-09-30 7

2024-09-30 7 -

上海市杨浦区2020-2021学年六年级上学期期末语文试题(解析版)VIP免费

2024-09-30 15

2024-09-30 15 -

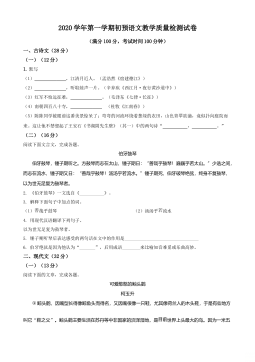

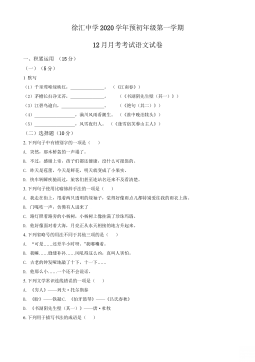

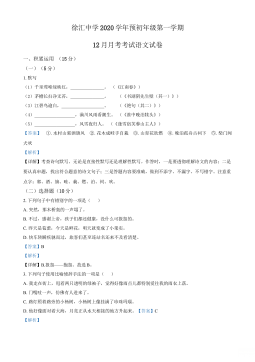

上海市徐汇中学2020-2021学年六年级(五四学制)上学期12月月考语文试题(原卷版)VIP免费

2024-09-30 11

2024-09-30 11 -

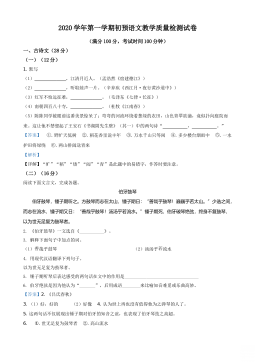

上海市徐汇中学2020-2021学年六年级(五四学制)上学期12月月考语文试题(解析版)VIP免费

2024-09-30 8

2024-09-30 8

相关内容

-

上海市徐汇区2019-2020学年六年级(五四学制)下学期期中语文试题(解析版)

分类:中小学教育资料

时间:2024-09-30

标签:无

格式:DOCX

价格:5 积分

-

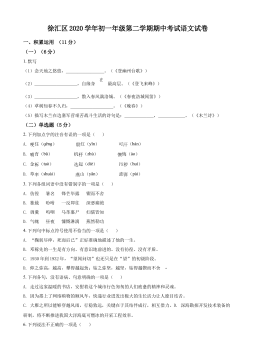

上海市徐汇区2019-2020学年六年级(五四学制)下学期期中语文试题(原卷版)

分类:中小学教育资料

时间:2024-09-30

标签:无

格式:DOCX

价格:5 积分

-

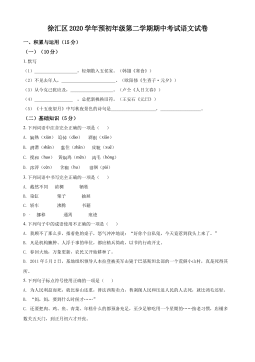

上海市徐汇区2020-2021学年(五四学制)六年级下学期期中语文试题(解析版)

分类:中小学教育资料

时间:2024-09-30

标签:无

格式:DOCX

价格:5 积分

-

上海市徐汇区2020-2021学年(五四学制)六年级下学期期中语文试题(原卷版)

分类:中小学教育资料

时间:2024-09-30

标签:无

格式:DOCX

价格:5 积分

-

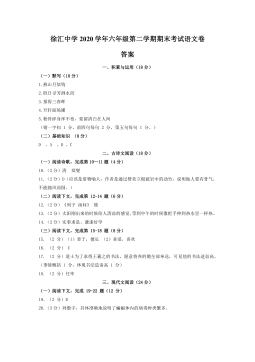

徐汇中学2020学年六年级第二学期试卷答案

分类:中小学教育资料

时间:2024-09-30

标签:无

格式:PDF

价格:5 积分